You are currently browsing the tag archive for the ‘teaching’ tag.

Uber Drivers tried to organize a strike to demand higher pay.

Uber drivers are competing with each for fares. The smaller the number of other drivers on the road, the greater the chance a driver get business. Also, when demand for rides outstrips supply of drivers, Uber might activate surge pricing to increase supply. Not only does a driver stand to get more business, he gets a higher fare/mile. The incentives to deviate from the strike are huge.

So, in Chicago, during the supposed strike, the number of Uber Drivers on the road was huge. Surge pricing was not activated because it was not necessary.

HT: An Uber driver.

I was on Chicago Tonight very briefly discussing Purple Pricing (see around 4 minute mark).

In 2008, the New South Wales government announced plans to build a coal mine here, promising jobs and cheap power. The coal business was booming because of demand from China. The government bought up 177 square miles of land for the mine project, boarding up 114 farms and homes.

Since then, coal prices have plummeted to their lowest level in years and the government has not been able to find a mining company willing to open a mine here. In 2013, the government abandoned its plans to develop the mine and last December appointed Goldman Sachs to sell the land.

By then, the district had lost 95 families, about 10 percent of its population. A sense of loss pervades the town, and residents feel blindsided by forces beyond their control.

Even for the airline industry, cheaper oil may not be all good, analysts say, if carriers see it as an opportunity to increase capacity and then lower fares to fill empty seats, some analysts say. Hunter Keay of Wolfe Research LLC recently noted that airlines did just that during a previous oil slump in 2010. “Then oil prices went right back up again, as they tend to, and 2011 stunk,” he wrote.

Paul Krugman has an op-ed today where he argues Amazon is abusing its power:

Which brings us back to the key question. Don’t tell me that Amazon is giving consumers what they want, or that it has earned its position. What matters is whether it has too much power, and is abusing that power. Well, it does, and it is.

Amazon is attempting to negotiate lower prices from the publisher Hachette and is slowing down sales of Hachette books on amazon.com in an attempt to force their hand. This is the main evidence.

But this kind of bargaining leads to lower prices for consumers not higher. Hence, from the perspective of welfare it is actually good. It is akin to the argument for reducing double marginalization via vertical integration. Double marginalization occurs because the primary producer (here Hachette) and the retailer (here Amazon) BOTH add a margin on to costs to maximize profits. Welfare would be higher and prices lower if they vertically integrated so some externalities are internalized. In fact, here is Krugman in 2000 explaining why breaking up Microsoft into Windows and Office is a bad idea:

In the last few days the Justice Department, outraged by the lack of contrition among Microsoft executives, has apparently decided to seek a ”horizontal” breakup of the software company — that is, to split it into one company that sells the Windows operating system (the upstream castle) and another that sells Microsoft Office and other applications (the downstream castle)….

even if you believe that Bill Gates has broken the law, you don’t want to impose a punishment that hurts the general public. And even strong critics of Microsoft have worried that a horizontal breakup would have a perverse effect: the now ”naked” operating-system company would abandon its traditional pricing restraint and use its still formidable monopoly power to charge much more. And at the same time applications software that now comes free would also start to carry hefty price tags.

As we know from ECON 101, integration is just one way to internalize externalities. Another would be for the retailer to negotiate lower prices from the producer so they are closer to production costs. Another would be for the producer to force the retailer to charge a lower margin. As both sides try to negotiate such deals which are good for them but bad for the other side, there is a war of attrition as we see currently. Sure Amazon’s tactics may be a bit crude but this is the typical kind of negotiation that lowers input costs and eventually prices. Hachette’s tactics are harder to observe but I would bet they are not so different.

(Update Oct 21: Spelled out some more details!)

Norway and Liberia (somewhat) internalize externalities:

Norway will give Liberia up to a hundred and fifty million dollars in aid, in exchange for which Liberia will work to stop the rapid destruction of its trees.

Liberia has much of what remains of West Africa’s rain forest, but logging is rampant. The initiative is not an act of charity but a trade: Liberia gets income, which it needs; Norway gets to preserve biodiversity and take a small step against climate change. A similar deal that Norway struck with Brazil years ago helped slow deforestation there. Economists call arrangements of this kind “payments for ecosystem services,” and they follow a rationale known as the Coase theorem. In 1960, the economist Ronald Coase argued that bargaining between parties could, under certain conditions, produce a mutually beneficial and efficient solution to problems like pollution.

Brazil and US subvert efficiency via transfers:

When the WTO’s Appellate Body upheld Brazil’s claim that U.S. cotton subsidies were depressing world prices and hurting Brazilian cotton farmers in the process, the United States did not amend its subsidies to make them compliant. Rather, it agreed to pay Brazil $147 million a year for the privilege of continuing to subsidize its own farmers in a WTO-inconsistent way. This week, the United States reached another settlement, buying Brazil’s peace once more, this time to the tune of a $300 million lump sum payment.

“It’s a simple logic, bigger is better,” said Ulrik Sanders, global head of the shipping practice at Boston Consulting, “if you can fill it.”

“There’s too much capacity in the market and that drives down prices,” he continued. “From an industry perspective, it doesn’t make any sense. But from an individual company perspective, it makes a lot of sense. It’s a very tricky thing.”

Amazon wants to use small bricks-and-mortar retailers to sell more Kindles and eBooks. They are trying to incentivize them to execute their business strategy:

Retailers can choose between two programs:

1) Bookseller Program: Earn 10% of the price of every Kindle book purchased by their customers from their Kindle devices for two years from device purchase. This is in addition to the discount the bookseller receives when purchasing the devices and accessories from Amazon.

2) General Retail Program: Receive a larger discount when purchasing the devices from Amazon, but do not receive revenue from their customers’ Kindle book purchases.

EBooks are an existential threat to retailers. But no one small bookstore can have a significant effect on the probability of the success of the eBook market through its own choice of whether to join Amazon’s program or not. Hence, it can ignore this existential issue in making its own choice. Suppose it is beneficial for a small bookstore owner to join the program ceteris paribus. After all, people are coming in, browsing and then heading to Amazon to buy eBooks – why not capture some of that revenue? Many owners independently make the decision to join the program. Kindle and eBook penetration increases even further and small bookstores disappear.

Remember how Mr. Miyagi taught The Karate Kid how to fight? Wax on/Wax off. Paint the fence. Don’t forget to breathe. A coach is the coach because he knows what the student needs to do to advance. A big problem for coaches is that the most precocious students also (naturally) think they know what they need to learn.

If Mr. Miyagi told Daniel that he needed endless repetition of certain specific hand movements to learn karate, Daniel would have rebelled and demanded to learn more and advance more quickly. Mr. Miyagi used ambiguity to evade conflict.

An artist with natural gift for expression needs to learn convention. But she may disagree with the teacher about how much time should be spent learning convention. If the teacher simply gives her exercises to do without explanation her decision to comply will be on the basis of an overall judgment of whether this teacher, on average, knows best. To instead say “You must learn conventions, here are some exercises for that” runs the risk that the student moderates the exercises in line with her own judgment about the importance of convention.

Google discontinued their appointment slots feature of Google Calendar. I was using that to schedule meetings with students. It was really nice because I could just block out some time for meetings and send a link to students and they would just sign up for 30 minute slots in the block. But no more. Does anybody know of a good alternative?

“JPMorgan Chase & Co. (JPM) asked more than 2,000 current and former employees to contribute to a settlement with the U.K.’s tax authority over their use of an offshore trust for bonus payments, according to a person briefed on the situation…..

People who used JPMorgan’s trust told the FT they were asked to participate in a so-called blind auction, in which they would volunteer to pay a tax rate of their choosing.

If the auction fails to generate enough money to fund the settlement, people who submitted less than the average bid would be excluded from the deal and face a 52 percent tax rate when the trust’s assets are liquidated, the newspaper said.

People who don’t wish to participate can try to fight the government’s demand, the person briefed on the situation said.”

The rules of the auction are not 100% clear from the article. Taken at face value, there is the possibility of multiple coordination equilibria. If I expect everyone else to contribute a lot but not enough to pay off the tax debt, then I will contribute a lot too to avoid the 52% tax. If I expect everyone to contribute a little, so will I hoping people who decided not to participate or contributed less than the average bid will bear the punishment. Finally, if I expect total contributions to exceed the tax debt, I will contribute zero. Uncertainty about everyone’s willingness to pay, deep pockets etc will generate randomness and perhaps refine equilibria but leave open the possibility of multiplicity. Also, there will be positive probability that the auction does not fully recompense the tax authorities. This is also true in mixed strategy equilibria of the complete information game.

To increase contributions and guarantee success, the auction should specify that everyone who contributes more than the average bid will escape the 52% tax if total contributions are lacking. Then, people will submit more than the average just to be safe. Then, the average expected bid will go up. Then, they’ll submit even more etc.

The remaining videos for my Intermediate Microeconomics course have been uploaded for your viewing pleasure. Here’s a sample, and the rest are all at the link.

From The Wages of Wins Journal:

I’ve decided to lump speed together with all of these other (hypothesized) factors under the general heading of “Floor Stretch”. We’ll use it for an exercise in theoretical sports economics…Whatever it is that truly makes up “Floor Stretch”, it has to be sufficiently valuable that it offsets the lower raw productivity of the smaller players….

Floor Stretch, however, is really a relative function. Having 5 point guards on the floor only stretches the other team if they don’t also have 5 point guards playing. In this sense, what we really care about is the ratio of Floor Stretch between the two teams competing. Theoretically, the Floor Stretch ratio is what the raw productivity must be balanced against in order to determine the best mix of players. This, then, gets us into some classical Game Theory….

I’m too focussed on the election to digest fully. But I got this from Goolsbee’s Twitter feed today – he must be confident?

Lee Crawfurd emails me about events in Sudan. North and South Sudan have agreed to a price at which the North will supply oil to the South. On his blog, Roving Bandit, Lee writes:

So – whilst this seems like a good deal for North Sudan in the short run and a good deal for South Sudan in the long run, my main concern is the hold-up problem. What is stopping North Sudan ripping up the agreement in 3 years, demanding a higher cut, and just confiscating oil (again).

In his email he adds:

As it turns out, the South’s strategy is to resume piping oil through the North, but also to simultaneously build a pipeline through Kenya, giving them an extra option.

The fact that the North can hold up later makes it less likely that the North and South will invest and trade in their relationship now. This makes both the North and South worse off. For this difficulty to be resolved, the North has to be able to commit not to exploit the South in the future. But the Kenyan pipeline gives them this commitment power to some extent: If the North threatens to raise prices, the South can go the Kenya route. This means the North will not raise prices in the future and that is good for trade and the welfare of both parties. Paraphrasing the wrods of the great philosopher Sting, “If Someone Does Not Trust You, Set Them Free“.

One issue is that the South may overinvest in the pipeline to get more bargaining power. That could lead to inefficiency as the North then has bad incentives.

Another classic Williamsonian solution is to use hostages to support exchange. I don’t know enough about North and South Sudan to know what they might transfer that is of little value to the recipient and high value to the donor. This sort of solution has been attempted recently in the US in the debt reduction negotiations. Automatic cuts in defense (bad for Republicans) and entitlement expenditures (bad for Democrats) go into force in January if Republicans and Democrats do not agree in debt negotiations. This has not worked so far. First, this is because there are crazy types who are willing to send the country over the “fiscal cliff”. Second, this is because there is no commitment and the automatic cuts can be delayed by Congress and so they are not real hostages.

My memory is terrible but I vaguely recall papers relating to investment in changing outside options in hold up models. These would be the most relevant to the Sudan scenario.

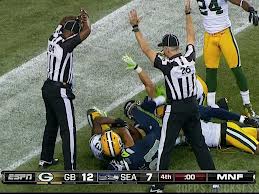

For the casual fan such as myself, the final second of the Packers-Seahawks game had the thrill of the Roman circus – an arbitrary, conflicted decision was handed down by emperor referees. For the real fans and the teams, it must be torture. But is it painful for the owners? After all, they will influence the decision in the labor dispute with referees. Steve Young thinks not:

The NFL is “inelastic for demand,” Young said, meaning that nothing — including poor officiating — can deter a significant percentage of fans and corporate sponsors away from the most popular game in the country. It’s the primary reason the NFL has held steady in its labor impasse with regular officials: There is no sign that enough of the sporting public cares to make it a priority.

“There is nothing they can do to hurt the demand of the game,” Young said in the video. “So the bottom line is they don’t care. Player safety doesn’t matter in this case. Bring Division III officials? Doesn’t matter. Because in the end you’re still going to watch the game.”

But the NFL/referee dispute is partly about “pay for performance” – the NFL wants to bench referees who botch calls (the money issues are trifling as a fraction of NFL revenue). This suggests the NFL does actually care about good officiating. This makes them weak in the face of the current officiating. They should cave sooner rather than later.

Mitt Romney and Paul Ryan have proposed a plan to allow private firms to compete with Medicare to provide healthcare to retirees. Beginning in 2023, all retirees would get a payment from the federal government to choose either Medicare or a private plan. The contribution would be set at the second lowest bid made by any approved plan.

Competition has brought us cheap high definition TVs, personal computers and other electronic goods but it won’t give us cheap healthcare. The healthcare market is complex because some individuals are more likely to require healthcare than others. The first point is that as firms target their plans to the healthy, competition is more likely to increase costs than lower them. David Cutler and Peter Orzag have made this argument. But there is a second point: the same factors that lead to higher healthcare costs also work against competition between Medicare and private plans. Unlike producers of HDTVs, private plans will not cut prices to attract more consumers so competition will not reduce the price of Medicare. A simple example exposes the logic of these two arguments.

Suppose there are two couples, Harry and Louise and Larry and Harriet. Harry and Louise have a healthy lifestyle and won’t need much healthcare but Larry and Harriet are unhealthy and are likely to require costly treatments in the future. Let’s say the Medicare price is $25,000/head as this gives Medicare “zero profits”. Harry and Louise incur much lower costs than this and Larry and Harriet much higher. Therefore, at the federal contribution, private plans make a profit if they insure Harry and Louise and a loss if they insure Larry and Harriet. So, private providers will insure the former and reject the latter. Or their plans deliberately exclude medical treatments that Larry and Harriet might need to discourage them from joining. The overall effect will be to increase healthcare costs. This is because Harry and Louise get premium support of $50,00 total that is greater than the healthcare costs they incur now so they impose higher costs on the federal government than they do currently. Larry and Harriet will be excluded by the private plans and will get coverage from Medicare. This will cost more than $50,000 total so there will be no cost savings from them either. Total costs will be higher than $100,00 as surplus is being handed over to Harry and Louise and their insurance companies.

To deal with this cream-skimming, we might regulate the marketplace. It might seem to make sense to require open enrollment to all private plans and stipulate that all plans at a minimum have the same benefits as the traditional Medicare plan. Indeed, the Romney/Ryan plan includes these two regulations. But this just creates a new problem.

Suppose the Medicare plan and all the private plans are being sold at the same price. The private plans target marketing at healthy individuals like Harry and Louise and include benefits such as “free” gym membership that are more likely to appeal to them. Hence, they still cream-skim to some extent and achieve a better selection of participants than the traditional public option. (This is actually the kind of thing that happens in the current Medicare Advantage system. Sarah Kliff has an article about it and Mark Duggan et al have an academic working paper studying Medicare Advantage in some detail.) So total healthcare costs will again be higher than in the traditional Medicare system.

But there is an additional effect. Traditional competitive analysis would predict that one private plan or another will undercut the other plans to get more sales and make more profits. This is the process that gives us cheap HDTVs. The hope is that similar price competition should reduce the costs of healthcare. Unfortunately, competition will not work in this way in the healthcare market because of adverse selection.

Going back to our story, if one plan is cheaper than the others priced at say $20,000, it will attract huge interest, both from healthy Harry and Louise but also from unhealthy Larry and Harriet. After all, by law, it must offer the same minimum basket of benefits as all the other plans. So everyone will want to choose the cheaper plan because they get same minimum benefits anyway. Also by law, the plan must accept everyone who applies including Larry and Harriet. So, while the cheapest plan will get lots of demand, it will attract unhealthy individuals whom the insurer would prefer to exclude – this is adverse selection. Insurers get a better shot at excluding Larry and Harriet if they keep their price high and dump them on Medicare. This means profits of private plans might actually be higher if the price is kept high and equal to the other plans and the business strategy focused on ensuring good selection rather than low prices. An HDTV producer doesn’t face any strange incentives like this– for them a sale is a sale and there is no threat of future costs from bad selection.

So, adverse selection prevents the kind of competition that lowers prices. The invisible hand of the market cannot reduce costs of provision by replacing the visible hand of the government.

- Second-sourcing. You are a monopolist selling a durable good that requires periodic upgrades. Think enterprise software. The monopoly price extracts the lifetime user-value of the product. To maximize the lifetime user-value of the product you should set the price for future upgrades at cost. The problem is that your users don’t trust you. They foresee that at the time of the upgrade, when the original purchase price of the software is a sunk cost you are not going to set upgrade prices at cost. Indeed you will again try to extract the (remaining) lifetime user-value of the product with the upgrade price. You need a device to commit yourself not to try to exploit your customers in the future so that you they will submit to your exploitation today. By spinning off a division of your company you can create a competitor for upgrades. This competition guarantees that you cannot act like a monopolist for upgrades and the upgrade price will be competitively priced at cost.

- Pre-emption. You are currently a monopolist in an industry that can accommodate at most two firms. It is inevitable that there will be an entrant eventually and your monopoly profits will turn into duopolist profits. Since you are going to have a competitor anyway why not create your own competitor? You could sell half of your company to the highest bidder. He will be willing to pay up to the duopolist profits and then he will compete with you driving the profits of your remaining half down to the duopolist profits. In total your profits are equal to the sum of the two duopolist’s profits rather than just a single duopolist profit. That’s necessarily less than the monopoly profit but that wasn’t going to last anyway.

A distinguished colleague (whom I will spare the outing) teaches in the lecture room after me. I received this email from him:

Subject: Any chance you could erase the Leverdome blackboard?

Or is this a Coase theorem thing?

Not the Coase Theorem, no. The Coase Theorem is all about parties coming together to form agreeements that enhance welfare. No, my dust-bound comrade this is much simpler seeing as how aggregate welfare is improved by the unilateral deviation of a single agent, namely me.

You see those days when we were following the conventional norm, according to which each Professor erases the chalkboard after his own lecture leaving a clean board for the next class, we were leaving a free lunch just sitting there on the table. Because any one of us could have changed course, leaving the board to be erased by the next guy before his class, thus triggering a switch to the superior erase-before convention.

Now as I am sure I don’t have to explain to you, once the convention is settled every Professor erases exactly once per day. So nobody is any worse off. But as you have by now noticed, that one particular Professor who initiated the switch avoids erasing that one time and is therefore strictly better off. A Pareto improvement! but of course you are now well-trained at spotting those having just yesterday surveyed my lecture notes covering that very subject as you were erasing them from the Leverdome chalkboard.

This week I switched to models of conflict where each player puts positive probability on his opponent being a dominant strategy type who is hawkish/aggressive in all circumstances. This possibility increases the incentive of a player to be aggressive if actions are strategic complements and decreases it if actions are strategic substitutes. The idea that fear of an opponent’s motives might drive an otherwise dovish player into aggression comes up in Thucydides (“The growth of Athenian power and the fear this caused in Sparta, made war inevitable.”) and also Hobbes. But both sides might be afraid and this simply escalates the fear logic further. This was most crisply stated by Schelling in his work on the reciprocal fear of surprise attack (“[I]f I go downstairs to investigate a noise at night, with a gun in my hand, and find myself face to face with a burglar who has a gun in his hand, there is a danger of an outcome that neither of us desires. Even if he prefers to leave quietly, and I wish him to, there is a danger that he may think I want to shoot, and shoot first. Worse, there is danger that he may think that I think he wants to shoot. Or he may think that I think he thinks I want to shoot. And so on.”). Similar ideas also crop up in the work of political scientist Robert Jervis.

Two sided incomplete information can generate this kind of effect. It arises in global games and can imply there is a unique equilibrium while there are multiple equilibria in the underlying complete information game. But the theory of global games relies on players’ information being highly correlated. Schelling’s logic does not seem to rely on correlation and we can imagine conflict scenarios where types/information are independent and yet this phenomenon still arises. In this lecture, I use joint work with Tomas Sjöström to identify a common logic for uniqueness that is at work for information structures with positively correlated types or independent types. Our sufficient conditions for uniqueness can be related to conditions that imply uniqueness in models of Bertrand and Cournot competition.

With these models in hand, we have some way of operationalizing Hobbes’ second motive for war, fear. I will use these results and models in future classes when I use them as building blocks to study other issues. Here are the slides.

There is pressure for filibuster reform in the Senate. Passing the threshold of sixty to even hold a vote was hard in the last couple of years when the Democrats had a large majority. It’s going to be near impossible now their ranks are smaller. Changing the rules has a short run benefit – easier to get stuff passed – but a long run cost – the Republicans will use the same rules to pass their legislation when Sarah Palin is President. Taking the long view, the Democrats decided not to go this route.

By the same token, the kind delaying tactics that did not work in the lame duck session are an efficiency loss – they had little real effect on legislation but delayed the Senators taking the kind of long holidays they are used to. Some movement on delaying tactics is mutually beneficial. And so according to the NYT:

“Mr. Reid pledged that he would exercise restraint in using his power to block Republicans from trying to offer amendments on the floor, in exchange for a Republican promise to not try to erect procedural hurdles to bringing bills to the floor.

And in exchange for the Democratic leaders agreeing not to curtail filibusters by means of a simple majority vote, as some Democratic Senators had wanted to do, Senator Mitch McConnell of Kentucky, the Republican leader, said he would refrain from trying that same tactic in two years, should the Republicans gain control of the Senate in the next election.”

I am teaching a new PhD course this year called “Conflict and Cooperation”. The title is broad enough to include almost anything I want to teach. This is an advantage – total freedom! – but also a problem – what should I teach? The course is meant to be about environments with weak property rights where one player can achieve surplus by stealing it and not creating it. To give some structure, I have adopted Hobbes’s theories of conflict to give structure to the lectures. Hobbes says the three sources of conflict are greed, fear and honour. The solution is to have a government or Leviathan which enforces property rights.

Perhaps reputation models à la Kreps-Milgrom-Roberts-Wilson come closest to offering a game theoretic analysis of honour (e.g. altruism in the finitely repeated prisoner’s dilemma). But I will only do these if I get the time as this material is taught in many courses. So, I decided to begin with greed.

I started with the classic guns vs butter dilemma: why produce butter when you can produce guns and steal someone else’s butter? This incentive leads to two kinds of inefficiency: (1) guns are not directly productive and (2) surplus is destroyed in war waged with guns. The second inefficiency might be eliminated via transfers (the Coase Theorem in this setting). This still leaves the first inefficiency which is similar to the underinvestment result in hold-up models in the style of Grossman-Hart-Moore. With incomplete information, there can be inefficient war as well. A weak country has the incentive to pretend to be tough to extract surplus from another. If its bluff is called, there is a costly war. (Next time, I will move this material to a later lecture on asymmetric information and conflict as it does not really fit here.)

These models have bilateral conflict. If there are many players, there is room for coalitions to form, pool guns, and beat up weaker players and steal their wealth. What are stable distributions of wealth? Do they involve a dictator and/or a few superpowers? Are more equitable distributions feasible in this environment? It turns out the answer is “yes” if players are “far-sighted”. If I help a coalition beat up some other players, maybe my former coalition-mates will turn on me next. Knowing this, I should just refuse to join them in their initial foray. This can make equitable distributions of wealth stable.

I am writing up notes and slides as I am writing a book on this topic with Tomas Sjöström. Here are some slides.

It appears to be intended for using illustrative experiments in an undergraduate-level course in game theory.

This site is based on the perception of game theory as the study of a set ofconsiderations used by individuals in strategic situations. Models are not seen as depictions of how individuals actually play game-like situations and are not meant to be used as the basis for a recommendation on how to play real “games”. My goal as a teacher is to deliver a loud and clear message that game theoretic models are not meant to supply predictions of strategic behavior in real life.

Professor Richard Quinn informs his Business Strategy class at the University of Central Florida that “forensic analysis” of the data gives him a good sense of who cheated on the midterm exam. (The link has video of the scolding.) Such a good sense that he can provide the administration with a list that he is “95% certain includes everyone who cheated on the exam.” (Quick: can you come up with such a list, even without seeing the data?) Unfortunately he can’t be as sure of the converse: that everyone on that list was a cheater.

So he is offering a deal to his students. They can individually confess to cheating, attend a 4 hour ethics course and receive amnesty, or they can take the risk that they will not be caught. What would you do?

- Professor Quinn’s speech reveals that the only evidence for cheating is an anonymous tip plus a suspicious grade distribution. Based only on this the only signal that you cheated was that your score was high. But it’s not credible to punish people just for having a high score.

- If Professor Quinn expects his gambit to work and for cheaters to turn themselves in, then he should believe that everyone who doesn’t turn himself in is innocent. So you should not turn yourself in.

- The biggest fear is that someone who you collaborated with turns himself in and he is induced to rat you out. Then as long as you are not sure who knows you were in on the scam you should turn yourself in.

- It’s surprising that this possibility was never mentioned in Professor Quinn’s rant because without it, his threat loses much of its force.

- The fact that he didn’t raise this possibility reveals that he is not so interested in rounding up every last cheater but simply to get a large enough number to confess. That way he can say that a lesson was learned. This suggests that you should confess only if you think that your confession will just push the total number of confessions over that threshold. Unlikely (unless everyone is thinking like you.)

Step 1: The 41-year-old should begin by having his first child when he is 32.

Step 2: when the child is 6 she should begin taking piano lessons.

Step 3: the 41-year-old’s mother should consistently beat him at golf.

Step 4: At age 39, notice that you can hit the ball twice as far as your mother and therefore there is no good reason she should always win. Notice that as long as your ball is always closer to the hole than your mother’s you will win.

Step 5: Use this strategy to actually beat your mother at golf for the first time.

Step 6: Notice that the same strategy applies to playing the piano vis a vis the now 7-year-old daughter.

Step 7: Begin attending daughter’s piano lessons and learning all of her pieces with the plan that you will always be a better pianist than her, even when she is a concert-playing professional.

Step 8: Around age 40 notice that this is going a little slowly and so its time to start learning some serious pieces.

Step 9: At age 41, learn to play Children’s Song #6 by Chick Corea.

It’s not very good. My hands get tired toward the end of the fast sections and you can see that I lose the rhythm a bit. Also I am rushing. (still ahead of my daughter though 🙂

I have never taken piano lessons, but I think I might start.

The lead article in the June 2010 edition of the Journal of Political Economy is

| Does Professor Quality Matter? Evidence from Random Assignment of Students to Professors | ||

| Scott E. Carrell and James E West | ||

Student evaluations may not be a good signal of teaching quality because

“Professors can inflate grades or reduce academic content to elevate student evaluations.”

The authors argue that if a student takes Calculus I, say, their performance in Calculus II is a good signal of how well they learned the material in Calculus I. So their study:

“uses a unique panel data set from the United States Air Force Academy (USAFA) in which students

are randomly assigned to professors over a wide variety of standardized core courses. The random assignment of students to professors, along with a vast amount of data on both professors and students, allows us to

examine how professor quality affects student achievement free from the usual problems of self-selection. Furthermore, performance in USAFA core courses is a consistent measure of student achievement

because faculty members teaching the same course use an identical syllabus and give the same exams during a common testing period. Finally, USAFA students are required to take and are randomly assigned

to numerous follow-on courses in mathematics, humanities, basic sciences, and engineering. Performance in these mandatory follow-on courses is arguably a more persistent measurement of student learning.

Thus, a distinct advantage of our data is that even if a student has a particularly poor introductory course professor, he or she still is required to take the follow-on related curriculum.”

Their methodology:

“We start by estimating professor quality using teacher value-added in the contemporaneous course. We then estimate value-added for subsequent classes that require the introductory course

as a prerequisite and examine how these two measures covary. That is, we estimate whether high- (low-) value-added professors in the introductory course are high- (low-) value-added professors for student

achievement in follow-on related curriculum. Finally, we examine how these two measures of professor value-added (contemporaneous and follow-on achievement) correlate with professor observable attributes

and student evaluations of professors. These analyses give us a unique opportunity to compare the relationship between value-added models (currently used to measure primary and secondary teacher quality) and

student evaluations (currently used to measure postsecondary teacher quality).

Their findings:

Results show that there are statistically significant and sizable differences in student achievement across introductory course professors in both contemporaneous and follow-on course achievement. However,

our results indicate that professors who excel at promoting contemporaneous student achievement, on average, harm the subsequent performance of their students in more advanced classes. Academic rank,

teaching experience, and terminal degree status of professors are negatively correlated with contemporaneous value-added but positively correlated with follow-on course value-added. Hence, students of less

experienced instructors who do not possess a doctorate perform significantly better in the contemporaneous course but perform worse in the follow-on related curriculum.

For example:

As an illustration, the introductory calculus professor in our sample who ranks dead last in deep learning ranks sixth and seventh best in student evaluations and contemporaneous value-added, respectively.

Required reading for all serious teachers and students and Deans. Ungated version

See this interesting new approach to MBA teaching. Here is an interesting novel approach by a new school in Moscow and the associated Times story:

New York Times, April 1, B1

MBA students pay high fees, leave the job market for two years and lose income and face the stress of getting a job when they’re done. Why?

The value added from an MBA must be high. Where does it come from? The teaching, the professors, the exams and grades. All that value has to be substantial. But undoubtedly, another huge part of the value comes from meeting other like-minded, smart, beautiful, go-getting people.

But the value of networking can be generated without a bricks-and-mortals B School. At least this is the bet taken by a budding education entrepreneur, Anton Napolitanokich, based in Moscow.

“Leading B Schools in the US and Europe are not going to risk their reputation by going digital,” said Napolitanokich. “And nor are great students in those regions going to give up the brand reputation that a HBS degree gives you to do something risky. But here in Moscow, there is little competition and a more amenable market. The Virtual MBA is the future of business education”

Napolitanokich’s business model is based on social networking websites like Facebook and as well pure, old-fashioned “networking” in nightclubs! “MBA students are in constant wireless contact already. All they need is someone to screen the group they interact with. That’s the key to what the traditional bricks and mortar B Schools do and we will replicate that. Of course we are total unknowns right now. So, we will do an excellent job letting in great students in our first round. We will let them in for free to prime the pump. If it works out, everyone will want to interact with our star students. In the next rounds, we will auction off entry into this select group It is kind of like a nightclub: you let in the good-looking people for free and then wait for everyone else to line up to get in. Of course, we can’t let in everyone – we have to maintain a high quality pool. So, we’ll restrict the number of spots and let the bidding takeoff! If it works, the price will be even higher than a traditional MBA! Go to www.virtualmba.com and apply for admission right away! It’s the future – even Sergey Brin is interested in the idea. He’s from Moscow you know. Brin ses we are the new Amazon and they are the old Barnes and Noble”

But what will the students actually be doing? Napolitanokich envisages that students will play interactive business games. The point of the games is more to get the students to get to know each other, establish networks and friendships. In a business coup, Napolitanokich has partnered with Disney to produce interactive business games. Disney’s Club Penguin website has been a huge hit with the elementary school set. Kids get to choose an avatar in penguin form to play interactive video games and hang out with other avatar penguins in chat rooms. Napolitanokich envisages a similar scenario for the b school games. Preppy J Crew wearing MBA avatars will engage in strategic competition, negotiation and marketing and have time to relax in virtual bars and restaurants. Disney finds the model every promising and hopes to create connecting sites all the way from Club Penguin up the age ladder to Virtual MBA, training budding entrepreneurs in high school.

Of course, only so much can be achieved by networking remotely. Actual face-to-face communication is vital too. Napolitanokich envisages intense live-in weeks where flocks of virtual MBAs fly in to isolated resort locations for intense interactive teaching sessions. So, some professors are inescapable he admits. But they will be a new breed of hyper-profs, flying in and out for short trips, living everywhere and nowhere. Ciphers who facilitate and coordinate student-student interaction but otherwise get out of the way. The still young century welcomes a new model for education.

Hope it does not work out for Anton, otherwise I’m out of a job!

One of the simplest and yet most central insights of information economics is that, independent of the classical technological constraints, transactions costs, trading frictions, etc., standing in the way of efficient employment of resources is an informational constraint. How do you find out what the efficient allocation is and implement it when the answer depends on the preferences of individuals? Any institution, whether or not it is a market, is implicitly a channel for individuals to communicate their preferences and a rule which determines an allocation based on those preferences. Understanding this connection, individuals cannot be expected to faithfully communicate their true preferences unless the rule gives them adequate incentive.

As we saw last time there typically does not exist any rule which does this and at the same time produces an efficient allocation. This result is deeper than “market failure” because it has nothing to do with markets per se. It applies to markets as well as any other idealized institution we could dream up.

So how are we to judge the efficiency of markets when we know that they didnt have any chance of being efficient in the first place? That is the topic of this lecture.

Let’s refer to the efficient allocation rule as the first-best. In the language of mechanism design the first-best is typically not feasible because it is not incentive-compatible. Given this, we can ask what is the closest we can get to the first best using a mechanism that is incentive compatible (and budget-balanced.) That is a well-posed constrained optimization problem and the solution to that problem we call the second best.

Information economics tells us we should measure existing institutions relative to the second best. In this lecture I demonstrate how to use the properties of incentive-compatibility and budget balance to characterize the second-best mechanism in the public goods problem we have been looking at. (Previously the espresso machine problem.)

I am particularly proud of these notes because as you will see this is a complete characterization of second-best mechanisms (remember: dominant strategies)for public goods entirely based on a graphical argument. And the characterization is especially nice: any second-best mechanism reduces to a simple rule where the contributors are assigned ex ante a share of the cost and asked whether they are willing to contribute their share. Production of the public good requires unanimity.

For example, the very simple mechanism we started with, in which two roomates share the cost of an espresso machine equally, is the unique symmetric second-best mechanism. We argued at the beginning that this mechanism is inefficient and now we see that the inefficiency is inevitable and there is no way to improve upon it.

Here are the notes.

Now we have set the stage. We are considering social choice problems with transferrable utility. We want to achieve Pareto efficient outcomes which in this context is equivalent to utilitarianism.

Now we face the next problem. How do we know what the efficient policy is? It of course depends on the preferences of individuals and any institution must implicitly involve providing a medium through which preferences are communicated and mediated. In this lecture I introduce this idea in the context of a simple example.

Two roomates are condering purchasing an espresso machine. The machine costs $50. Each has a maximum willingness to pay, but each knows only his own willingness to pay and not the others. It is efficient to buy the machine if and only if the sum exceeds $50. They have to decide two things: whether or not to buy the machine and how to share the cost. I ask the class what they would do in this situation.

A natural proposal is to share the cost equally. I show that this is inefficient because it may be that one roomate has a high willingness to pay, say $40, and the other has a low willingness to pay, say $20. The sum exceeds $50 but one roomate will reject splitting the cost. This leads to discussion of how to improve the mechanism. Students propose clever mechanisms and we work out how each of them can be manipulated and we discover the conflict between efficiency and incentive-compatibility. There is scope for some very engaging class discussions here that create a good mindset for the coming more careful treatment.

At this stage I tell the students that these mechanisms create something like a game played by the roomates and if we are going to get a good handle on how institutions perform we need to start by developing a theory of how people play games like this. So we will take a quick detour into game theory.

For most of this class, very little game theory is necessary. So I begin by giving the basic notation and defining dominated and dominant strategies. I introduce all of these concepts through a hilarious video: The Golden Balls Split or Steal Game (which I have blogged here before.) I play the beginning video to setup the situation, then pause it and show how the game described in the video can be formally captured in our notation. Next I play the middle of the video where the two players engage in “pre-play communication.” I pause the video and have a discussion about what the players should do and whether they think that communication should matter. I poll the class on what they would do and what they predict the two players will do. Then I show them the dominant strategies.

Finally I play the conclusion of the video. Its a pretty fun moment. I conclude with a game to play in class. This year I had just started using Twitter and I came up with a fun game to play on Twitter. I blogged about this game previously.

(By the way this game is extremely interesting theoretically. I am pretty confident that this game would always succeed in implementing the desired outcome: getting the target number of players to sign up, but it is not easy to analyze because of the continuous time nature. The basic logic is this: if you think that the target will not be met, then you should sign up immediately. But then the target will be met.)

Here are the lecture slides.

After the showstopper that is Arrow’s Theorem, we could just throw in the towel. The motivation for studying social welfare functions was to find a coherent standard by which to judge institutions and to propose policies. Now we see that there is no coherent standard. Well students you are not getting away so easily, after all this is only the second week of the course. We will accept that we must violate one of the axioms. Which one do we choose?

A lot of normative economic theory is implicitly built upon one of two welfare criteria, either Pareto efficiency or utilitarianism. While it is standard to formally define Pareto efficiency in an undergraduate micro class, utilitarianism is often invoked without explicit mention. For example, we are implicitly using some form of utilitarianism when we talk about consumer and producer surplus. And to argue that a monopoly is inefficient in a partial equilibrium framework is a utilitarian judgment (absent compensating transfers.)

So I make it explicit. And I take the time to formally define utilitarianism, explain where it applies and what justifies it and I point out its limitations. In terms of Arrow’s theorem I tell the students that we are dropping the axiom of universal domain (UD.) That is, we are not requiring our social welfare function to apply in all situations, only in those situations in which there is a valid measure of welfare that can be transferred and/or compared inter-personally. In this class, that measure of welfare is willingness to pay, and it applies when there are monetary transfers available and all agents value money in equal terms, i.e. quasi-linear utility.

These lectures contain one important formal result. In the quasi-linear world with monetary transfers utilitarianism coincides with Pareto efficiency. So these two common welfare standards are the same. (Any utilitarian improvement can be made into a Pareto improvement with judiciously chosen transfers and any Pareto improvement is a utilitarian improvement.)

Here are the notes.