The last of Strogatz’ series blog entries on mathematics and it may be the best one:

For the Hilbert Hotel doesn’t merely have hundreds of rooms — it has an infinite number of them. Whenever a new guest arrives, the manager shifts the occupant of room 1 to room 2, room 2 to room 3, and so on. That frees up room 1 for the newcomer, and accommodates everyone else as well (though inconveniencing them by the move).

Now suppose infinitely many new guests arrive, sweaty and short-tempered. No problem. The unflappable manager moves the occupant of room 1 to room 2, room 2 to room 4, room 3 to room 6, and so on. This doubling trick opens up all the odd-numbered rooms — infinitely many of them — for the new guests.

Later that night, an endless convoy of buses rumbles up to reception. There are infinitely many buses, and worse still, each one is loaded with an infinity of crabby people demanding that the hotel live up to its motto, “There’s always room at the Hilbert Hotel.”

The manager has faced this challenge before and takes it in stride.

Read on for more highly accessible writing on Cantor’s infinities.

Something to revisit when the fiscal cliff negotiations make you mad.

From a city council vote in Kentucky:

Robert McDonald learned the hard way that every vote counts.

McDonald, who is known to most people as Bobby, finished in a dead heat Tuesday with Olivia Ballou for the sixth and final seat on the Walton City Council.

Each candidate captured 669 votes, but one ballot McDonald is sure would have gone his way was never cast. His wife, Katie, who works nights as a patient care assistant at Christ Hospital and is finishing nurse’s training at Gateway Community and Technical College, didn’t make it to the polls yesterday.

“If she had just been able to get in to vote, we wouldn’t be going through any of this,” McDonald said. “You never think it will come down to one vote, but I’m here to tell you that it does.”

McDonald, 27, said his wife did not want to talk about not voting.

“She feels bad enough,” McDonald said. “She worked extra hours, goes to school and we have three kids, so I don’t blame her. She woke up about ten minutes before the polls closed and asked if she should run up, but I told her I didn’t think one vote would matter.”

My daughter was learning about prime numbers and she had an exercise to identify all the prime numbers less than 100. I made a little game out of it with her by offering her 10 cents for each number correctly categorized as prime or composite within a fixed total time.

As she progressed through the numbers I noticed a pattern. It took her less time to guess that a number was composite than it took her to guess that it was prime. And of course there is a simple reason: you know that a number is composite once you find a proper factor, you know that a number is prime only when you are convinced that a proper factor does not exist.

But this was a timed-constrained task and waiting until she knows for sure that the number is prime is not an optimal strategy. She should guess that the number is prime once she thinks it is sufficiently likely that she won’t find any proper factor. And how long that will take depends on the average time it takes to find a proper factor.

In particular, if the average time before she guesses prime is larger than the average time before she guesses composite then she is not optimizing. Because if that were the case she should infer that the number is likely to be prime simply from the fact that she has spent more than the average time looking for a proper factor. At an optimum, any such introspective inference should be arbitraged away.

From The Wages of Wins Journal:

I’ve decided to lump speed together with all of these other (hypothesized) factors under the general heading of “Floor Stretch”. We’ll use it for an exercise in theoretical sports economics…Whatever it is that truly makes up “Floor Stretch”, it has to be sufficiently valuable that it offsets the lower raw productivity of the smaller players….

Floor Stretch, however, is really a relative function. Having 5 point guards on the floor only stretches the other team if they don’t also have 5 point guards playing. In this sense, what we really care about is the ratio of Floor Stretch between the two teams competing. Theoretically, the Floor Stretch ratio is what the raw productivity must be balanced against in order to determine the best mix of players. This, then, gets us into some classical Game Theory….

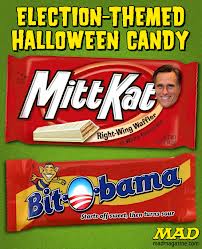

I’m too focussed on the election to digest fully. But I got this from Goolsbee’s Twitter feed today – he must be confident?

The average voter’s prior belief is that the incumbent is better than the challenger. Because without knowing anything more about either candidate, you know that the incumbent defeated a previous opponent. To the extent that the previous electoral outcome was based on the voters’ information about the candidates this is good news about the current incumbent. No such inference can be made about the challenger.

Headline events that occurred during the current incumbent’s term were likely to generate additional information about the incumbent’s fitness for office. The bigger the headline the more correlated that information is going to be among the voters. For example, a significant natural disaster such as Hurricane Katrina or Hurricane Sandy is likely to have a large common effect on how voters’ evaluate the incumbent’s ability to manage a crisis.

For exactly this reason, an event like that is bad for the incumbent on average. Because the incumbent begins with the advantage of the prior. The upside benefit of a good signal is therefore much smaller than the downside risk of a bad signal.

As I understand it, this is the theory developed in a paper by Ethan Bueno de Mesquita and Scott Ashworth, who use it to explain how events outside of the control of political leaders (like natural disasters) seem, empirically, to be blamed on incumbents. This pattern emerges in their model not because voters are confused about political accountability, but instead through the informational channel outlined above.

It occurs to me that such a model also explains the benefit of saturation advertising. The incumbent unleashes a barrage of ads to drive voters away from their televisions thus cutting them off from information and blunting the associated risks. Note that after the first Obama-Romney debate, Obama’s national poll numbers went south but they held steady in most of the battleground states where voters had already been subjected to weeks of wall-to-wall advertising.

In 1797 Johann Wolfgang von Goethe had completed a new poem Hermann and Dorothea, and he was interested in knowing and publicizing its “true worth.” So he concocted a scheme with his lawyer Mr. Bottiger and wrote this in a letter to his publisher:

I am inclined to offer Mr. Vieweg from Berlin an epic poem, Hermann and Dorothea, which will have approximately 2000 hexameters…. Concerning the royalty we will proceed as follows: I will hand over to Mr. Counsel B6ttiger a sealed note which contains my demand, and I wait for what Mr. Vieweg will suggest to offer for my work. If his offer is lower than my demand, then I take my note back, unopened, and the negotiation is broken. If, however, his offer is higher, then I will not ask for more than what is written in the note to be opened by Mr. Bottiger.

To understand this scheme first consider the alternative scenario where the publisher is told the amount demanded. Then the publisher will say yes or no depending on whether his willingness to pay (the poem’s “true worth”) exceeds or falls short of the demand. But then Goethe would never know exactly the poem’s true worth, just an upper or lower bound for it.

With the demand kept secret, the publisher’s incentives remain the same: he wants to agree to a demand that is below his willingness to pay and refuse a demand that exceeds it. Without knowing what that demand is, there is one and only one way to ensure this. The publisher should offer exactly the poem’s true worth.

Goethe had devised what is apparently the first dominant-strategy incentive compatible truthful revelation mechanism. The Vickrey auction is based on exactly this principle and so Goethe’s mechanism makes for a great starting point for teaching efficient auctions.

(quote is from “Goethe’s Second-Price Auction” by Moldovanu and Tietzel. Mortarboard mosey: Markus Mobius.)

In a striking last-minute shift, the Romney campaign has decided to invest its most precious resource — the candidate’s time — in a serious play to win Pennsylvania.

Mr. Romney’s appearance here on Sunday could be a crafty political move to seriously undercut President Obama, or it could be a sign of desperation. Either way, his visit represents the biggest jolt yet in a state that was until recently largely ignored in the race for the White House.

Over the last several days, with polls showing Mr. Obama’s edge in the state narrowing, Republicans have sprung into action and forced the Democrats to spend resources here that could have gone toward more competitive battleground states.

In a previous post, I discussed why it might be profitable to move ad budgets to non-battleground states if battlegrounds are saturated with coverage. Basically, if you are strong in the battleground states, by spending money in a non-battleground state, you can divert your competitor’s resources there too and, if you are weak, you have to go there out of necessity. Hence, you cannot determine whether Romney has momentum or not from his ad spending strategy. But what about his travel strategy? A candidate’s time is scarce, unlike his billion dollar ad budget, so it must be rationed carefully. So, what can we infer from the fact that Romney is campaigning in PA on Sunday?

The New York Times Electoral Map is useful to think through various scenarios. Romney needs to win NC, FL and VA to have any chance of making it to the White House. Visiting and campaigning in those states is part of his defensive strategy – he has no option but to devote attention to them. As everyone is saying, OH is the key to the door of the White House.

What should Romney do if he knows the President has a significant lead in OH? There is no point campaigning even more in VA, NC or FL because even if he wins them, he cannot win the Presidency without some other states. He has to shift campaigning to some other states to make it to 269 electoral votes so the House can give him the Presidency. Then, it might seem he should shift his time to CO, IA, NH or WI. But to make it to 269, Romney would have to win WI, CO and one of the other two (according to my manipulation of the NYT map). This is a tall order. On the other hand, if he wins PA with one of these other four states, he is through. MN does not have enough electoral votes to counterbalance a loss of OH so the choice comes down to MI versus PA. If Romney is closer in PA than MI, that breaks the tie. So, to summarize, it makes more sense to campaign in PA and try to win one other state than to try to win WI, CO and one other.

What if Romney is ahead in OH? Then, he still needs one of CO, NH, IA or WI to win. Not focussing on those states and defending OH, VA etc. exclusively could cost him the Presidency. In this scenario, Romney does not have the luxury of the time to campaign in PA.

Hence, the Romney campaign’s focus on PA only really makes sense if they know President Obama is well ahead in OH. There is no Romentum.

UPDATE (11/3): From NBC,

On party ID

In these surveys, Democrats enjoy a nine-point party-identification advantage in Ohio and a two-point edge in Florida. Republicans have argued that a nine-point advantage is too large in this current political environment; it was eight points in the Buckeye State during Obama’s decisive 2008 victory.

If you cut that party ID advantage in half, Obama’s six-point lead in Ohio is reduced to three points.

This is kinda gross:

In a new paper published online Oct. 8 in the journal Cell, Breslin and colleagues propose a theory of food pairings that explains for the first time how astringent and fatty foods oppose one another to create a balanced “mouthfeel.”

Because fat is oily, eating it lubricates the mouth, making it feel slick or even slimy, Breslin said. Meanwhile, astringents, chemical compounds such as the tannins in wine and green tea, make the mouth feel dry and rough. They do this by chemically binding with lubricant proteins present in saliva, causing the proteins to clump together and solidify, and leaving the surface of the tongue and gums without their usual coating of lubrication. [Tip of the Tongue: The 7 (Other) Flavors Humans May Taste]

We don’t like slimy, but we don’t like puckered up, either. “We want our mouth to be lubricated but not overly lubricated,” Breslin told LiveScience. “In our study, we show that astringents reduce the lubricants in the mouth during a fatty meal and return balance.”

I take Rationalization to be the act of having a theory before you approach data and then cherry-picking the data that fits your theory. This leads to Self-Deception (or maybe deception if you are doing the cherry-picking to trick other people).

In a possibly related comment, here is the Nov 6 projection from UnSkewed Polls:

What is the Democratic equivalent to UnSkewed Polls? I do not know. My guess is they would forecast same as 2008: Obama 365, McCain 173. Or would they add in AZ and TX because of the large Latino populations?

The Romney campaign is expanding ad buys beyond the battleground states. Is there a huge swell of enthusiasm so Romney is trying for a blowout or is it a bluff?

The traditional model of political advertizing is the Blotto game. Each candidate can divide up a budget across n states. Each candidate’s probability of winning at a location is increasing in his expenditure and decreasing in the other’s. These models are hard to solve for explicitly. What makes this election unusual is that the usual binding constraint – money – is slack in the battleground states. Instead, full employment of TV ad time and voter exhaustion with ads makes further expenditure unnecessary. But, you can still spend the money on improving your get-out-the-vote operation or to expand your ad buy to other states. Finally, you can send your candidate to a state. Your strategy varies as function of how close the race is.

If the battleground states are increasingly unlikely to be in your column, then a get out the vote strategy will not be enough to tip them back in your favor. Better to try to make some other state close by advertizing and mobilizing there. You must maintain your ad buy though in the battleground states to keep your competitor engaged so that they cannot divert resources themselves.

If the battleground states are close, then a get out the vote operation is quite useful even if ad spending is at its maximum. Better to do that than spend money in other locations where you are way behind.

If you are far ahead in the battleground states, you have to keep on spending there as your competitor is spending there either because he might win or to keep you spending there. But, cash you have sloshing around should be spent “expanding the map”. This gives you more paths to victory and also exerts a negative externality on your opponent, forcing him to divert resources including perhaps the most valuable resource of all, the candidate’s time.

So, you might spend heavily in a state even when you have little chance there. This always has the benefit of diverting your opponent’s attention. This means there is an incentive for a player to invest even if he is far ahead in the battleground states. But there is also an incentive to invest when you are behind as you need more paths to victory and expenditure on getting out the vote is less useful. So, we can’t infer Romentum from the fact that Romney is advertizing in MN and PA.

I think we can make stronger inferences by making a leap of faith and extrapolating this intuition to a state by state analysis. By comparing strategies with public polls, we can try to classify them into the three categories.

NC seems to fall into the first category for President Obama. Romney is ahead according to the polls but it gives the Obama campaign more ways to win and keeps the Romney resources stretched. Romney is roughly as far behind in MI, MN and PA as Obama is in NC. So, they play the same role for Romney as NC does for Obama. Bill Clinton and Joe Biden are campaigning in PA and MN so the Romney strategy has succeeded in diverting resources.

The most scarce resource is candidate time so we can infer a lot from the candidate recent travel and their travel plans. If the race is close in any states it would be crazy to try a diversion strategy as a candidate visit acts like a get out the vote strategy and hence has great benefits when the race is close. The President is campaigning in WI, FL, NV, VA and CO. In fact, both candidates are frequently in FL and VA. NC is a strong state for Romney because, as far as I can tell, he has no plans to visit there and nor does the President. Similarly, I don’t see any Romney pans to visit MI, MN or PA. Also, NV also seems to be out of Romney’s grasp as he has no plans to travel there. It is hard to make inferences about NH as Romney lives there so it is easy to campaign. OH has so many electoral votes that no candidate can afford not to campaign there – again no inferences can be made. Both candidates are in IA.

So, I think the state by state evidence is against Romentum. NC and NV do not seem to be in play. The rest of the battleground states are going to enjoy many candidate visits so they must be close. That’s about all I have!

- Its socially valuable for the University of Michigan measure consumer confidence and announce it even if that is an irrelevant statistic. Because otherwise somebody with less neutral motives would invent it, manipulate it, and publicize it.

- Kids are not purely selfish. They like it when they get better stuff than their siblings. To such an extent that they often feel mistreated when they see a sibling get some goodies.

- Someone should develop a behavioral theory of how people play Rock, Scissors, Paper when its common knowledge that humans can’t generate random sequences.

- The shoulder is the kludgiest joint because there are infinitely many ways to do any one movement. Almost surely you have settled into a sub-optimal way.

- I go to a million different places for lunch but at each one I always order one dish.

There is a stockpile of bottled water over here and a bunch of thirsty people over there. What should be done?

Before you can answer that question you first have to figure out what is possible. Don’t think yet about what institution or economic system you are going to use to bring about the outcome, first just ask what is feasible in principle.

There are two choices to make. First, which consumers will get water bottles (the allocation). And second, how much money will be transferred from the consumers to the suppliers (the transfers).

The welfare associated with any choice can be summarized by a pair of numbers: the total utility or surplus of consumers and the surplus of producers. You can plot the set of all such pairs that can be generated by some choice of allocation and transfers on a graph where consumer surplus is on one axis and producer surplus is on the other.

We are really interested in the Pareto efficient choices: the ones on the frontier of the feasible set. In our problem the frontier is a line with slope negative 1. Here’s how you achieve these points. First you allocate all of the water bottles to those consumers who value them the most. This achieves the maximum total surplus. Then you specify transfers in order to distribute this surplus in various ways between suppliers and consumers. As you vary the transfers you move along the frontier swapping producer for consumer surplus dollar for dollar.

Now that you have the feasible set you ask yourself what your social welfare function is. That is, how do you compare different points on the graph? You are essentially saying how you evaluate tradeoffs which reduce the utility of one individual and raise the utility of another. Once you have settled on a standard you choose the best point from the frontier according to that standard.

Then you start asking what economic system you can use to achieve it.

The price system is one. But the price system has a big problem. When water bottles are allocated by setting a price the two dimensions in your graph collapse into one. For example, if you want to achieve the surplus maximizing allocation with a price you are forced to accept one particular division of that surplus. There is a market clearing price p and every consumer who gets a bottle of water pays p to a supplier.

Another way of saying this is that market clearing prices correspond to one single point on your frontier. Is it the point you wanted before you started considering the price system as a mechanism? That would be quite an accident. And barring such a coincidence you are now left asking what else could be done within the confines of the price system?

You can choose a price different from the market clearing price. As you vary the price you do two things. First, you worsen the allocation and as a result total surplus goes down. So you move inside the old frontier. That’s bad. Second, you change the division of surplus. This traces out a new frontier giving you more than one choice. That’s good.

Now you can consult your social welfare function again and ask which point on the price-system-generated frontier do you like the best. Will it be the point corresponding to market-clearing prices? Of course it depends on your social welfare function but again it would be quite a coincidence.

For example it could be that market-clearing prices are very high and give almost all surplus to producers and leave consumers with close to zero surplus. If your social welfare function has diminishing marginal rate of substitution of one individual’s utility for another (whether they are consumers or producers, it doesn’t really matter) you will prefer a more interior point which would be achieved by setting prices below market-clearing levels. You are essentially willing to reduce total surplus by a bit (due to misallocation) in order to achieve a better distribution.

Thus, my response to Erik Brynjolffson, who writes in the comments to my post on price gouging:

Producers also are people, just like consumers, and we’d like to see their utility increased, ceteris paribus. Thus, even if production decisions don’t change, I don’t follow your argument that we should put zero weight on producer surplus.

is that nowhen did I say that we should do that and it’s not part of the argument. Instead the argument is that as long as you don’t think we should always be indifferent to arbitrarily reducing the surplus of one party in favor of another (again regardless of who is a consumer or a supplier) then your optimal price will not be the market-clearing price.

Let me emphasize that this is a very special problem because the quantity of water bottles was given, we don’t have to worry about incentives to produce. Another effect of the price system is to provide those incentives. And when supply is elastic, distorting prices reduces welfare for another reason: the quantity is distorted. The point I am making applies in the special cases when this distortion is small. For example when supply lines are cut in a natural disaster.

Other commenters, like Tyler Cowen, argue that supply cannot be considered perfectly inelastic even in rare, unexpected natural disasters. That’s true, but this is not a limiting argument. It doesn’t require perfectly inelastic supply. The tradeoff is still there with highly, but not perfectly, inelastic supply.

Michael McDonald, a political science professor at George Mason University, constantly updates the numbers. In the early voting, NV, IA seem to be leaning Obama, CO is leaning Romney and FL is close. Hard to map OH counties into DEM and REP districts.

[L]ike millions of other people up and down the East Coast, we stocked up this weekend on peanut butter and crackers and powdered milk and bottled water and cans of beans and tomatoes and tuna. The prices for all those things were the same as they always are…

Even in states without price gouging laws, most stores won’t raise prices for generators or bottled water or canned food. Which raises a question: Why? Why doesn’t price go up when demand increases? Why don’t we see more price gouging?

The people Kahneman surveyed said they would punish businesses that raised prices in ways that seemed unfair. While I would have paid twice the normal price for my groceries yesterday, I would have felt like I was getting ripped off. After the storm passed, I might have started getting my groceries somewhere else.

Businesses know this. And, Kahneman argues, when basic economic theory conflicts with peoples’ perception of fairness, it’s in a firm’s long-term interest to behave in a way that people think is fair.

The reasoning of the store is an impeccable rational choice strategy: even if the store owner wants to make money in the short run, he forgoes the extra profit in the short run to make money in the long run. That is, even if he is not altruistic, he plays the same strategy as the altruist by refraining from price gouging. That leaves the consumer. In one version, suppose the consumer does not know if he is dealing with an altruistic store owner or a “rational” player. If the store price gouges, the consumers learns the store owner is not an altruist as an altruist would never price gouge. The consumer cares about the future, like the store owner. Since the store owner is rational, he may cheat the consumer sometime in the future. This could be because of end game effects when the store owner is desperate for cash or because he thinks he is has lost the consumer’s long run business so they have switched to a “bad” equilibrium of the repeated game. (This is standard repeated game reasoning in the style of Abreu-Pearce-Stacchetti or Fudenberg-Levine-Maskin or reputation reasoning in the style of Kreps-Milgrom-Roberts-Wilson.) So, the consumer rationally does not buy in the future from a store that price gouged him in the present not because of unfairness but because he will be cheated by the store owner. So the store and consumer strategies hang together as an equilibrium based on rational choice principles.

This narrative should be added to the storybook of rational choice analysis as well as behavioral economics alternatives.

Eli Dourado wrote this on Twitter:

Despair. RT @GovChristie: The State Division of Consumer Affairs will look closely at any and all complaints about alleged price gouging.

When there’s a natural disaster some people, like Gov. Christie, start complaining in knee-jerk fashion about price gouging. And then some other people, with their knees jerking in exactly the same fashion, start complaining about people who complain about price gouging. The latter sets of knees usually belong to economists.

Suppose that an unexpected shock has occurred which has two effects. First, it increases demand for, say bottled water. Second, it cuts off supply lines so that in the short-run the quantity of bottled water in the relevant location is fixed at Q. A basic principle of economics is that if you wish to maximize total surplus then you should allow the price to adjust to its market-clearing level. This ensures that those Q consumers with the highest value for water get it. The total surplus will then be the sum of all their values.

The price plays two roles in this process, one crucial to the result, one just incidental and not necessarily intended. First, it separates out the high-value consumers from the low-value consumers. That’s the crucial role. Unavoidably it also plays a second role of taking some of that total surplus away from the consumers and giving it to producers. If you are maximizing total surplus you are completely indifferent to that second effect.

But what if you don’t want to maximize total surplus but just want to maximize consumers’ surplus? Your goal is that the Q bottles of water you’ve got should generate the greatest possible benefit for those who will consume them. I would bet that most people who understand the previous paragraph also assume that it applies equally well to the problem of maximizing consumer’s surplus. How else would you maximize it but to ensure that those with the highest value get the water?

But in fact it is quite typical for the consumer surplus maximizing solution to be a rationing system with a price below market clearing. I devoted a series of posts to this point last year. The basic idea is that the efficiency gains you get from separating the high-values from the low-values can be more than offset by the high prices necessary to achieve that and the corresponding loss of consumer surplus.

Why would we only care about consumers’ surplus and not also the surplus that goes to producers? We normally we care about producer’s surplus because that’s what gives producers an incentive to produce in the first place. But remember that a natural disaster has occurred. It wasn’t expected. Production already happened. Whatever we decide to do when that unexpected event occurs will have no effect on production decisions. We get a freebie chance to maximize consumer’s surplus without negative incentive effects on producers. And just at the time when we really care about the surplus of bottled water consumers!

Of course there are other good reasons to be skeptical of rationing in practice. It might not be enforceable, it might lead to inefficient rent-seeking, etc. But these objections mean that the debate should be about rationing in practice. The theoretical argument against it is weaker than many people think.

A useful post by Peter Kellner at YouGov:

In all polls these days, the raw data must be handled with care. It’s normal for the sample to contain too many people in some groups, and too few in others. So all reputable pollsters adjust their raw data to remove these errors. It is standard practice to ensure that the published figures, after correcting these errors, contain the right number of people by age, gender, region and either social class (Britain) or highest educational qualification (US). Most US polls also weight by race.

Beyond that, there are two schools of thought. Should polls correct ONLY for these demographic factors, or should they also seek to ensure that their published figures are politically balanced? In Britain these days, most companies employ political weighting. YouGov anchors its polls in what our panel members told us at the last general election; other companies ask people in each poll how they voted in 2010, and use this information to adjust their raw data. Ipsos-MORI are unusual in NOT applying any political weighting.

Pew and ABC/Washington Post polls on the other hand does not control for party ID. Comparing election outcomes state by state on Nov 6 with election forecasts ay allow us to discriminate among these various philosophies.

Tyler Cowen and Kevin Grier mention a curious fact:

Economists Andrew Healy, Neil Malhotra, and Cecilia Mo make this argument in afascinating article in the Proceedings of the National Academy of Science. They examined whether the outcomes of college football games on the eve of elections for presidents, senators, and governors affected the choices voters made. They found that a win by the local team, in the week before an election, raises the vote going to the incumbent by around 1.5 percentage points. When it comes to the 20 highest attendance teams—big athletic programs like the University of Michigan, Oklahoma, and Southern Cal—a victory on the eve of an election pushes the vote for the incumbent up by 3 percentage points. That’s a lot of votes, certainly more than the margin of victory in a tight race. And these results aren’t based on just a handful of games or political seasons; the data were taken from 62 big-time college teams from 1964 to 2008.

And Andrew Gelman signs off on it.

I took a look at the study (I felt obliged to, as it combined two of my interests) and it seemed reasonable to me. There certainly could be some big selection bias going on that the authors (and I) didn’t think of, but I saw no obvious problems. So for now I’ll take their result at face value and will assume a 2 percentage-point effect. I’ll assume that this would be +1% for the incumbent party and -1% for the other party, I assume.

Let’s try this:

- Incumbents have an advantage on average.

- Higher overall turnout therefore implies a bigger margin for the incumbent, again on average.

- In sports, the home team has an advantage on average.

- Conditions that increase overall scoring amplify the advantage of the home team.

- Good weather increases overall turnout in an election and overall scoring in a football game.

So what looks like football causes elections could really be just good weather causes both. Note well, I have not actually read the paper but I did search for the word weather and it appears nowhere.

“Goran Arnqvist from Uppsala University has been studying the seed beetle’s nightmarish penis for years, using it as a model for understanding the more general evolutionary pressures behind diverse animal genitals. In 2009, he and colleage Cosima Hotzy found that males with the longest spines fertilise the most eggs and father the most young. It wasn’t clear why. Maybe they help him to anchor himself to the female, or scrape out rival sperm. Or perhaps the fact that the spines actually puncture the female is important. Regardless, long spines seemed to give males the edge in their sperm competitions.

But Hotzy and Arnqvist had only found a correlation, by comparing the penises of male seed beetles from around the world. To really test their ideas, they wanted to deliberately change the length of the spikes to see what effect that would have.

They did that in two ways: they artificially bred males for several generations to have either longer or short spines; and they shaved them with a laser….Both techniques produced males with differently sized spines, but similarly sized bodies.

The duo found that males with the shorter spines were indeed less likely to successfully fertilise the females. They also found clues as to why the males benefit from their long spines.”

The bottom line is that Boston fears scared Republicans won’t vote and Chicago fears confident Democrats won’t vote. And so, in this final stretch, Boston wants Republicans confident and Chicago wants Democrats scared. Keep that in mind as you read the spin.

In an patent race, the firm that is just about to pass the point where it wins the race and gets a patent has an incentive to slack off a bit and coast to victory. The competitor who is almost toast has an incentive to slack off as he has little chance of winning. But if the race is close, all firms work hard.

Elections are similar except the campaigns have the information about whether the campaign is close or not and the voters exert the costly effort of voting. Campaigns have an incentive to lie to maximize turnout so the team that’s ahead pretends not to be far ahead and the team that’s behind pretends the race is very close. As Klein says, no-one can believe their spin and no information can be credibly transmitted.

If they really want to influence the election, the campaigns have to take a costly action to attain credibility. For example, they can release internal polling. This gives their statements credibility at the cost of giving their opponent their internal polling data.

Can opposite-sex friendships last? Only if the two are mutually deceived:

The results suggest large gender differences in how men and women experience opposite-sex friendships. Men were much more attracted to their female friends than vice versa. Men were also more likely than women to think that their opposite-sex friends were attracted to them—a clearly misguided belief. In fact, men’s estimates of how attractive they were to their female friends had virtually nothing to do with how these women actually felt, and almost everything to do with how the men themselves felt—basically, males assumed that any romantic attraction they experienced was mutual, and were blind to the actual level of romantic interest felt by their female friends. Women, too, were blind to the mindset of their opposite-sex friends; because females generally were not attracted to their male friends, they assumed that this lack of attraction was mutual. As a result, men consistentlyoverestimated the level of attraction felt by their female friends and women consistently underestimated the level of attraction felt by their male friends.

At some level this is automatically true. Assume simply this: all men are attracted to all women. Then which women will the men be friends with? The ones they expect to be able to hook up with. Of these friendships few will survive: if she figures out he is attracted to her she will either hookup with him (if its mutual) or run away (if its not). Either way the platonic friendship ends. The only surviving friendships will be those in which he thinks she’s attracted to him, she’s not attracted to him and she hasn’t yet figured out he’s attracted to her. QED.

Jon Stewart asks Austan Goolsbee:

What we need to do in this country is make it a softer cushion for failure. Because what they say is the job creators need more tax cuts and they need a bigger payoff on the risk that they take. … But what about the risk of, you’re afraid to leave your job and be an entrepreneur because that’s where your health insurance is? … Why aren’t we able to sell this idea that you don’t have to amplify the payoff of risk to gain success in this country, you need to soften the damage of risk?

I guess there are two effects. First, as Stewart says, insurance against failure, including in the form of health insurance disconnected from a salaried job, encourages more people to become entrepreneurs. This is the occupational choice component. Second, insurance against failure reduces the incentive to work hard. This is the usual trade-off between risk-sharing and incentives in the classical principal-agent moral hazard model. The two effects move in opposite directions so the net effect on welfare is ambiguous (assuming we want more people to be entrepreneurs which is not clear!). As far as I know, the empirical work on the trade off between risk sharing and incentives finds weak support for any tradeoff. It would be nice to have a model to think things through. I assume someone must have written such a model but not sure of the reference.

Luigi Zingales writes that business schools are teaching MBA students to be criminals.

Oddly, most economists see their subject as divorced from morality. They liken themselves to physicists, who teach how atoms do behave, not how they should behave. But physicists do not teach to atoms, and atoms do not have free will. If they did, physicists would and should be concerned about how the atoms being instructed could change their behavior and affect the universe. Experimental evidence suggests that the teaching of economics does have an effect on students’ behavior: It makes them more selfish and less concerned about the common good. This is not intentional. Most teachers are not aware of what they are doing.

My colleague Gary Becker pioneered the economic study of crime. Employing a basic utilitarian approach, he compared the benefits of a crime with the expected cost of punishment (that is, the cost of punishment times the probability of receiving that punishment). While very insightful, Becker’s model, which had no intention of telling people how they should behave, had some unintended consequences. A former student of Becker’s told me that he found many of his classmates to be remarkably amoral, a fact he took as a sign that they interpreted Becker’s descriptive model of crime as prescriptive. They perceived any failure to commit a high-benefit crime with a low expected cost as a failure to act rationally, almost a proof of stupidity. The student’s experience is consistent with the experimental findings I mentioned above.

From the Atlantic channeling Rajiv Sethi and Justin Wolfers:

[T]his morning, something very weird happened on Intrade. Mitt Romney began the day trailing the president 60 to 40 (i.e.: his chance of winning was priced at 40%). Suddenly, Romney surged to 49%, and the president’s stock collapsed, despite no game-changing news in the press. The consensus on Twitter seemed to be that somebody tried to manipulate the market….

The total quantity of Romney stock traded between 9:57 and 10:03 was around $17,800. But that’s not the “cost” of this manipulation (if that’s what it was), because the buyer got stock in return. If we value that stock at 41 (rather than the higher price he paid), the net cost of this manipulation/error was about $1,250.

Meanwhile the UK bookies are giving Obama a 5 in 7 chance of winning. This gap between the UK berrint market and Intrade has existed for quite a while. Is some SuperPac spending money consistently to maintain the difference? The marginal benefit of more ads must by now be quite low. Maybe this is all that’s left to spend on.

I remember a commercial for some kind of diet program where that was the tagline. A disembodied hand kept enticing this poor guy with delicious looking food and then taking it away because it was unhealthy and then the voiceover came in with that line and I thought that was so tragic that everything that tastes good had to be bad for you. Like what kind of cruel joke is that?

And it makes no sense from a biological point of view. I should want to eat what’s good for me so that I do eat what’s good for me and avoid what’s bad for me. That’s Mother Nature’s optimal incentive scheme. And once we have evolved to the point that we can think and understand that principle we should be able to infer that whatever tastes good must in fact be good for us. But it’s not!

At the margin it’s not. Indeed the right statement is “If it tastes good then you surely have already had too much of it to the point that any more of it is bad for you.” Because the basic elements in food that we love, namely sugar, salt, and fat, are all not just good for us but pretty much essential for survival. And so of course we are programmed to like those things enough that we are incentivized to consume enough of them to survive.

But the decision whether to eat something is based on costs as well as benefits. Nature programmed our tastes so that we internalize the benefits but it’s up to us to figure out the costs: how abundant is it, how hard is it to acquire, and when it’s sitting there before us how likely is it that we will have a chance to eat it again in the near future. Then we need to weigh the costs and benefits and eat up to the quantity where marginal costs equal marginal benefits.

It’s interesting that Nature put a little price theory to use when she worked all this out. A price is a linear incentive scheme. Every additional unit you buy costs you the same price as the last one. Your taste for food is like a linear subsidy, every unit tastes about as good as the last, at least up to a point. When you face linear incentives like that you consume up to the point where your personal, idiosyncratic marginal cost equals the given marginal benefit. If a planner (like your Mother Nature) wants to get you to equate marginal cost and marginal benefit, a (negative) price is a crude incentive scheme because the true marginal benefits might be varying with quantity but the subsidy makes you act as if its constant.

But that’s ok when the price is set right. The planner just sets the subsidy equal to the marginal benefit at the optimal quantity. Then when you choose that quantity you will in fact be equating marginal cost to the true marginal benefit. That’s a basic pillar of price theory.

So Nature assumed she knew pretty well what the optimal quantity of sugar, salt, and fat are and gave us a taste for those elements that was commensurate with the true marginal benefit at that optimal point. And its pretty much a linear incentive scheme at least in a large neighborhood of the target quantity. Sugar, salt and fat don’t seem to diminish in appeal until we have had quite a lot of it.

The problem is that the optimal quantity depends on both the value function and the cost function. Now the value function, i.e. the health benefits of various consumption levels is probably the same as it has always been. But the cost function has changed a lot. Nature was never expecting Mountain Dew, Potato Chips and Ice Cream. The reduction in marginal cost means that the optimal quantity is higher, but how much higher? That depends on how the shape of the value function at higher quantities. The old linear incentive scheme contains no information at all about that.

But one thing is for sure. If the true marginal benefit is declining, then at higher quantities the linear incentive scheme built into our taste buds overstates the marginal benefit. So when we equate the new marginal cost to the linear price we are doing what is privately optimal for us but what is certainly too high compared to Nature’s optimum. If it tastes good its bad for us we because we have already had too much.

From Nature news.

Calcagno, in contrast, found that 3–6 years after publication, papers published on their second try are more highly cited on average than first-time papers in the same journal — regardless of whether the resubmissions moved to journals with higher or lower impact.

Calcagno and colleagues think that this reflects the influence of peer review: the input from referees and editors makes papers better, even if they get rejected at first.

Based on my experience with economics journals as an editor and author I highly doubt that. Authors pay very close attention to referees’ demands when they are asked to resubmit to the same journal because of course those same referees are going to decide on the next round. On the other hand authors pretty much ignore the advice of referees who have proven their incompetence by rejecting their paper.

Instead my hypothesis is that authors with good papers start at the top journals and expect a rejection or two (on average) before the paper finally lands somewhere reasonably good. Authors of bad papers submit them to bad journals and have them accepted right away. Drew Fudenberg suggested something similar.

There is a pattern to how people arrange themselves in elevators depending on the number of other passengers. (via The Morning News.)

If someone else comes in, we may have to move. And here, it has been observed that lift-travellers unthinkingly go through a set pattern of movements, as predetermined as a square dance.

On your own, you can do whatever you want – it’s your own little box.

If there are two of you, you take different corners. Standing diagonally across from each other creates the greatest distance.

When a third person enters, you will unconsciously form a triangle (breaking the analogy that some have made with dots on a dice). And when there is a fourth person it’s a square, with someone in every corner. A fifth person is probably going to have to stand in the middle.

I liked the part where it is explained why we are socially awkward in elevators.

“You don’t have enough space,” says Professor Babette Renneberg, a clinical psychologist at the Free University of Berlin.

I had just eaten a little plastic carton of yogurt and I tossed it into the recycling bin. She said “That yogurt carton needs to be rinsed before you can recycle it.” And I thought to myself “That can’t be true. First of all, the recyclers are going to clean whatever they get before they start processing it so it would be a waste for me to do it here. Plus, the minuscule welfare gains from recycling this small piece of plastic would be swamped by water, labor, and time costs of rinsing it.” I concluded that, as a matter of policy, I will not rinse my recyclable yogurt containers.

So I replied “Oh yeah you’re right.”

You see, I didn’t want to dig through the recycling bin and rinse that yogurt cup. By telling her that I agree with her general policy, I stood a chance of escaping its mandate in this particular instance. Because knowing that I share her overall objective, she would infer that was that my high private costs of digging through the recycling that dictated against it under these special circumstances. And she would agree with me that letting this exceptional case go was the right decision.

If instead I told her I disagreed with her policy, then she would know that my unwillingness was some mix of private costs and too little weight on the social costs. Even if she internalizes my private costs she would have reason to doubt they were large enough to justify a pass on the digging and rinsing and she might just insist on it.