You are currently browsing the category archive for the ‘economics’ category.

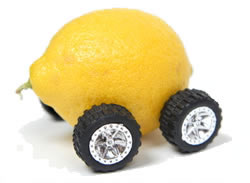

Chief Justice Roberts and four others found that the individual mandate could not be justified via the Commerce Clause (CC) in the Constitution. The CC allows the federal government to “regulate” interstate commerce. Roberts found that precedent allows the government to regulate activity via the CC but the individual mandate regulates inactivity and is hence unconstitutional (p. 20 of Roberts’ opinion):

The individual mandate, however, does not regulate existing commercial activity. It instead compels individuals to become active in commerce by purchasing a product, on the ground that their failure to do so affects interstate commerce. Construing the Commerce Clause to permit Congress to regulate individuals precisely because they are doing nothing would open a new and potentially vast domain to congressional authority.

Moreover (p. 22-23),

Indeed, the Government’s logic would justify a mandatory purchase to solve almost any problem…To consider a different example in the health care market, many Americans do not eat a balanced diet. That group makes up a larger percentage of the total population than those without health insurance…..The failure of that group to have a healthy diet increases health care costs, to a greater extent than the failure of the uninsured to purchase insurance….Those increased costs are borne in part by other Americans who must pay more, just as the uninsured shift costs to the insured….Congress addressed the insurance problem by ordering everyone to buy insurance. Under the Government’s theory, Congress could address the diet problem by ordering everyone to buy vegetables.

Let’s take a quick look at the broccoli market. At the prevailing price, absent regulation, some consumers are active in the market and buy broccoli and other are inactive and don’t buy broccoli. Similarly, there are some producers who sell broccoli and other potential sellers who, given the prevailing price, produce chilis. Domestic broccoli growers are mainly in California but many broccoli consumers live in the Acela corridor so there is interstate commerce.

Then, the government enters the broccoli market. Some say this is because of the health benefits of broccoli, others say this is because the broccoli growers have formed an effective lobby, much like the sugar producers. The government intervention comes in the form of a subsidy to broccoli consumers. Consumers who consume 1 lb of broccoli/week get a $300 deduction on their taxes (Whole Foods immediately starts selling an annual contract which can easily be appended to your IRS form to get the broccoli deduction.)

Consumers who were active before still continue to buy: after all they are getting an extra incentive to buy. But also consumers who were inactive before now start to buy: after all the broccoli vs arugula margin now favors broccoli. In fact there is a new annual demand curve for broccoli D'(p) where D'(p)=D(p-300) where D was the original demand curve. There is higher demand at every price and the price of broccoli goes up. This changes the broccoli-chili margin for producers and inactive broccoli producers now switch to activity. (Also, profits go up for broccoli producers giving them the incentive to lobby for a consumer subsidy.)

Therefore, intervention in the “active” market changes the active-inactive decision and influences inactivity. An equivalent policy is to use to stick rather than a carrot and impose a penalty of $300 on consumers who are consuming less that 52 pounds of broccoli/year. Appropriately chosen carrots and sticks are equivalent in terms of broccoli trade. (More broadly, a tax or subsidy to broccoli production could also implement the same output of broccoli.) This simple analysis has some implications for Democrats and Republicans.

First, many instruments can implement the same output so the fact that one kind of intervention has been deemed unconstitutional is not important. A carrot can replace a stick.

But, second, the instruments differ in their revenue implications. Carrots are expensive to the government and sticks raise revenue. More use of carrots means bigger deficits or distortionary taxes.

And, third, since penalizing inactivity is equivalent to incentivizing activity, we appear to have conflicting precedents. It is legal to regulate activity but not to regulate inactivity. But regulating activity impacts inactivity and if regulating inactivity is unconstitutional, in a roundabout way, the Roberts et al applies. On the other hand, there are plenty of precedents for regulating activity even if they influence inactivity. In the (in)famous Wickard case, quotas on farmers reduced activity and increased inactivity. I am not a lawyer so I can not sure what happens in this circumstance. I guess the Supremes get to vote and they can rationalize votes one way or the other based on conflicting precedents. All bets are off – will Roberts switch his vote at the last minute etc.?

Plenty of stuff for us citizens to contemplate on July 4. I’ll be grilling broccoli.

Orbitz Worldwide Inc. has found that people who use Apple Inc.’s Mac computers spend as much as 30% more a night on hotels, so the online travel agency is starting to show them different, and sometimes costlier, travel options than Windows visitors see.

Orbitz is not attempting third degree price discrimination:

Orbitz executives confirmed that the company is experimenting with showing different hotel offers to Mac and PC visitors, but said the company isn’t showing the same room to different users at different prices. They also pointed out that users can opt to rank results by price.

But is it just a matter of time?

At an all-you-can-buffet lunch, the incentives are clear: go back again and again, refill your plate and guzzle away. You would eat less if each new plate came with another price tag. Add to that a lack of self control and you get overconsumption and a desperate desire for a nap in the afternoon.

A CEO has a salaried employee. The employee gets paid much the same however much work he does. So, the CEO asks him to sit on this committee or investigate that new market or run recruiting etc. etc. Add to that moral suasion so it is a duty to work hard for the firm and you get overwork and a desperate desire to avoid the CEO. There will be many task forces and layers of bureaucracy as the cost of each initiative is so small. Better to pay for performance and internalize some of the costs of each extra foray into administration and work.

What is the difference between the Bowles-Simpson plan for deficit reduction vs President Obama’s plan? Ever wondered? I have. It seems the President’s plan calls for less cuts in Defense and Social Security but has more cuts in annual domestic spending. An Obama for America document summarizes the differences and of course does a comparison with the Romney plan. Romney’s plan is short on details so there is a lot of extrapolation. Is there an equivalent document put out by the Romney campaign?

So, we have found by Chris Bosh’s absence and then his presence that he is a significant part of the Miami Heat. But who is the fourth most important man on the team? An argument can be made that it is Shane Battier. A New Yorker story espouses the same theory. It led me to an old article by Michael Lewis. But just why is Battier so good? Lewis makes a telling point:

So, we have found by Chris Bosh’s absence and then his presence that he is a significant part of the Miami Heat. But who is the fourth most important man on the team? An argument can be made that it is Shane Battier. A New Yorker story espouses the same theory. It led me to an old article by Michael Lewis. But just why is Battier so good? Lewis makes a telling point:

There is a tension, peculiar to basketball, between the interests of the team and the interests of the individual. The game continually tempts the people who play it to do things that are not in the interest of the group. On the baseball field, it would be hard for a player to sacrifice his team’s interest for his own. Baseball is an individual sport masquerading as a team one: by doing what’s best for himself, the player nearly always also does what is best for his team….It is in basketball where the problems are most likely to be in the game — where the player, in his play, faces choices between maximizing his own perceived self-interest and winning. The choices are sufficiently complex that there is a fair chance he doesn’t fully grasp that he is making them.

Taking a bad shot when you don’t need to is only the most obvious example. A point guard might selfishly give up an open shot for an assist. You can see it happen every night, when he’s racing down court for an open layup, and instead of taking it, he passes it back to a trailing teammate. The teammate usually finishes with some sensational dunk, but the likelihood of scoring nevertheless declined. “The marginal assist is worth more money to the point guard than the marginal point,” Morey says. Blocked shots — they look great, but unless you secure the ball afterward, you haven’t helped your team all that much. Players love the spectacle of a ball being swatted into the fifth row, and it becomes a matter of personal indifference that the other team still gets the ball back…

Having watched Battier play for the past two and a half years, Morey has come to think of him as an exception: the most abnormally unselfish basketball player he has ever seen. Or rather, the player who seems one step ahead of the analysts, helping the team in all sorts of subtle, hard-to-measure ways that appear to violate his own personal interests.

This has two Holmstrom and Milgrom ideas: tension between individual incentives and team incentives; use of easily identifiable measures of output distorting incentives to invest is less identifiable costly tasks. And in the absence of monetary incentives and market efficiency, the only solution to the moral hazard problem is in ethical behavior (Arrow made similar points many years ago).

We have examples of markets crowding out morality. But what about the reverse?

Your Gran lives in your hometown. Your hometown has no decent jobs and is small for your large ambitions. You want to leave. But old Gran is a bit frail. She needs to go the doctor weekly and sometimes there are emergencies. Gran’s neighbor is a nurse, now a stay-at-home mom with kids in high school. You ask the neighbor if, in return for a weekly wage, she would be willing to take Gran to the doctor every week and respond to emergency calls. She agrees. You think this is a great solution. The neighbor is much better qualified than you to look after Gran in emergencies. Gran is going to get excellent care. And now you get to explore broader horizons and make use of your Executive MBA to work in private equity just like Mitt Romney.

But when you propose the plan to Gran she looks a bit sad. She knows many other Grans. All of them have dutiful grandsons who drive them to the doctor every week. She’s not going to be able to hold her head up high at the daily Granny meetings. You feel guilty. You stay in your hometown to help out your Gran.The deal with your neighbor is off. She takes a job cleaning houses. You get a job at a local steel mill doing their accounts. You lose your job when a private equity firm takes it over.

I am attending the Third Ravello workshop on The Economics of Coordination and Communication.The workshop has brought together micro, applied micro, macro and finance researchers unified by the research theme. I presented a paper offering a theory of the firm based on coordination. Salvatore Piccolo presented a paper on information sharing, joint work with Marco Pagnozzi. Christian Hellwig had a theory of bubbles based on heterogeneous beliefs but generated from a common prior. There are many theoretical and empirical papers on networks, by Sanjeev Goyal, Yves Zenou, Luigo Pistaferri and others.

There are many young Italian researchers and PhD students and the idea is partly to introduce them to contemporary research. I enjoyed the way the conference is organized around a theme (coordination) rather than afunctional specialty (theory, IO etc.). I got to see interesting papers that I would not normally see at the conferences and seminars I attend.

I went to a conference in Capri organized a few years ago and was very keen to come to this one. I was not disappointed. The location is spectacular. Ravello is perched on top of a mountain overlooking Amalfi. The food is quite good. As Ravello is quite hard to get to, we ourselves are the main tourist horde so the atmosphere is quite mellow. I hope I am invited again!

Cogent analysis by James Surowiecki at New Yorker:

[P]olicymakers are seriously discussing a so-called Grexit—in which Greece would default on its debts and abandon the euro.

This isn’t an outcome that anyone wants. Even though a devalued currency would make Greece’s exports cheaper and attract tourists, it would do so at a terrible price, destroying huge amounts of wealth and seriously harming the country’s G.D.P. It would be costly for the rest of Europe, too. Greece owes almost half a trillion euros, and containing the damage would likely require the recapitalization of banks, continent-wide deposit insurance (to prevent bank runs), and more aid to Portugal, Spain, and Italy, which seem to be the next countries in line to default. That’s a very high price to pay for getting rid of Greece, and much more expensive than letting it stay……

But the catch is that Europe isn’t arguing just about what the most sensible economic policy is. It’s arguing about what is fair. German voters and politicians think it’s unfair to ask Germany to continue to foot the bill for countries that lived beyond their means and piled up huge debts they can’t repay. They think it’s unfair to expect Germany to make an open-ended commitment to support these countries in the absence of meaningful reform. But Greek voters are equally certain that it’s unfair for them to suffer years of slim government budgets and high unemployment in order to repay foreign banks and richer northern neighbors, which have reaped outsized benefits from closer European integration……

The basic problem is that we care so much about fairness that we are often willing to sacrifice economic well-being to enforce it…. a famous experiment known as the ultimatum game—one person offers another a cut of a sum of money and the second person decides whether or not to accept—shows that people will walk away from free money if they feel that an offer is unfair. Thus, even when there’s a solution that would leave everyone better off, a fixation on fairness can make agreement impossible.

Hart and Moore and Hart and Holmstrom have offered theories of centralization based on behavioral issues. I’m not familiar with the other work on behavioral contract theory. But my guess is there is plenty of room for interesting research in the area along lines implicit in this article.

Philosopher Gary Gutting opines:

Public policy debates often involve appeals to results of work in social sciences like economics and sociology. For example, in his State of the Union address this year, President Obama cited a recent high-profile study to support his emphasis on evaluating teachers by their students’ test scores. The study purportedly shows that students with teachers who raise their standardized test scores are “more likely to attend college, earn higher salaries, live in better neighborhoods and save more for retirement.”

How much authority should we give to such work in our policy decisions? The question is important because media reports often seem to assume that any result presented as “scientific” has a claim to our serious attention. But this is hardly a reasonable view. There is considerable distance between, say, the confidence we should place in astronomers’ calculations of eclipses and a small marketing study suggesting that consumers prefer laundry soap in blue boxes.

Either we have to pay teachers according to test scores or not. A choice is unavoidable. Similarly, soap has to be packaged in some way, a choice is unavoidable. Better to make that choice based on research. If we can place great confidence in the research, all the better. But even if we have less confidence, so be it, because what choice do we have other than to use the research?

Jamie Dimon, head of JPMorgan Chase, argues against regulation because, according to him, it lumps in good bankers with bad bankers. For example, via Maureen Dowd,

After the economy nearly atomized in a cloud of cupidity, Dimon became known as America’s least-hated banker. But now the blunt 56-year-old Queens native who snowed Democrats in Washington with all his talk about not lumping in “good banks” with “bad banks” has fallen off his pedestal.

For us humble outsiders, it is hard to tell a good banker from a bad banker, particularly when even good bankers can’t catch a “whale”. This generates Gresham’s Law of Bankers – bad bankers adversely affect good bankers. If I am not sure if I am employing the services of a good banker or a bad banker, I am going to make transactions under an expected quality of banker. Then good bankers suffer as they are pooled with bad bankers.

Screening out the bad bankers via regulation can help the good bankers by creating separation.

Jean Tirole gave a paper on “Laws and Norms” as his Schwartz Lecture last week. He has been working on psychology and economics for many years with Roland Benabou. The presentation was an extension of that work. Consider a game where a costly action generates a positive externality. Agents are motivated to take such an action by a monetary reward and a private value from the action. However, they also care what others think of them. How can we think about this formally and what implications does it have for contributions to the public good?

Tirole’s (and Benabou’s) first contribution is to provide a simple, tractable model of this psychological effect. Each agent’s payoff is a function of others’ expectation of his private value given his action and monetary reward. Hence if you contributed to the public good but received no monetary reward, the expectation is different that if you contributed and got paid. From this simple formulation much can be deduced. If a contribution is elicited via a monetary reward, it carries less positive information about the contributor than one when there was no monetary reward. There might be a bigger contribution if there is no monetary reward. The less observable the contribution, the smaller is the incentive to make it etc.

The contribution was twofold. First, the mathematical modeling of the psychological effect requires some art and effort. Second, the model is intuitive and simple enough that others can use it to express their own ideas. One of my colleagues is thinking about two papers based on the basic Tirole model.

The American Economic Review publishes an unrefereed conference volume, Papers and Proceedings, in May of every year. Of course, the AER also a publishes a refereed journal which rejects more than 95% of submissions. Someone with an AER P&P might be tempted to pass it off as an AER on their CV. There is a possible gain in prestige at the cost of being found out and facing a social sanction. Snyder and Zidar call this the obfuscation theory. Alternatively, perhaps these AER P&Ps have real academic value and those who describe their own such papers as real publications should also cite other such papers more. Different conventions of citation may develop among different subgroups. This is the convention model. Snyder and Zidar find support for the convention model in the data. They mention that AER P&Ps had more citations that AERs in the past and hence older economists tend to see P&Ps as real publications while younger economists do not. This should imply that younger economists should be more careful about distinguishing P&Ps from AERs on their CVs.

I have two questions/comments.

An economist who lists a P&P as a refereed publication faces dissonance. On the one hand, they would like to see themselves as good people, on the other they know they are doing something shady. One way to resolve the dissonance is to cite other researchers P&Ps more. This helps propagate the self-deception that P&Ps are legitimate pieces of refereed research and hence listing them as such is justified.

Second, another possible paper: Do P&Ps have more errors than refereed publications? One job of a referee is to catch errors after all. If so, how many cites come from people pointing out mistakes?

(Hat Tip: MR)

Michael Ostrovsky (Stanford GSB) and Michael Schwarz (Yahoo! Research) helped Yahoo! to improve its click price per ad. Yahoo! was charging 10c/click. Ostrovsky and Schwarz ran some field experiments:

Reserve prices in the randomly selected “treatment” group were set

based on the guidance provided by the theory of optimal auctions, while in the “control” group

they were left at the old level of 10 cents per click. The revenues in the treatment group have

increased substantially relative to the control group, showing that reserve prices in auctions can in

fact play an important role and that theory provides a useful guide for setting them.

It seems they made money for Yahoo!:

We conclude with a quote from a Yahoo! executive, describing the overall impact of

improved reserve prices on company revenues.

On the [revenue per search] front I mentioned we grew 11% year-over-year in the quarter

[. . . ], so thats north of a 20% gap search growth rate in the US and that is a factor of,

attributed to rolling out a number of the product upgrades we’ve been doing. [Market

Reserve Pricing] was probably the most signi cant in terms of its impact in the quarter.

We had a full quarter impact of that in Q3, but we still have the bene t of rolling that

around the world.

Sue Decker, President, Yahoo! Inc. Q3 2008 Earnings Call.

But it seems Yahoo! is eliminating the entire research group in its downsizing, including I suppose Michael Schwarz. Preston McAfee had already left for Google Research. I hope others also have a soft landing.

Derrick Rose is out for the season and a weekend that started badly might have ended sadly with another super dark episode of Mad Men. Instead, we got a few comedic rays of sunshine to break through the gloom – Pete tricking Megan’s pretentious father, Peggy’s mother’s surprise that Abe’s favorite dish is ham etc. Those of us looking to enliven our courses with the odd example here or there had to wait till the end.

Don is busy trying to drum up new business at his award dinner. He got the award for an anti-cancer ad he took out in the newspaper after losing the Lucky Strike cigarette account. But a colleague’s father rains on Don’s parade. He says that no-one will give Don any new business after he stabbed Lucky Strike in the back. Don signaled to the wrong audience in the last period of the Lucky Strike game. He tried to co-opt consumers by pretending to be concerned about their welfare. But consumers will not give his firm new accounts, firms selling crap to them will. And with them Don lost his reputation – will he also throw them under the bus if things turn sour? Life is an infinite horizon game with many bilateral interactions. Lose your reputation in one and, if your behavior is publicly observable, lose your reputation in all.

Textbook stuff on exit, entry and shutdown decisions:

Gas rigs have been disappearing particularly fast since late October, the last time prices were above $4.

Essentially, gas is so cheap that it’s no longer profitable to drill.

“Producers typically need $5 [per 1,000 cubic feet] to break even,” says David Greely, an energy analyst atGoldman Sachs (GS). The industry hasn’t seen prices consistently over $5 since September 2010, back when there were nearly 1,000 rigs operating in the U.S. The number of gas rigs peaked near 1,600 in mid-2008, when prices peaked at $10. (The boom was effectively confirmed in June 2009, when a Colorado School of Mines report showed that U.S. natural gas reserves were 35 percent higher than previously estimated.)

Other analysts say $5 is too high and that the average gas producer can still make money with the price between $3 and $4, depending on the well because different types of wells have different cost structures. Newer, high-production wells can turn a profit even with prices below $2, while older wells that are just trickling out gas need much higher prices to make money. That’s probably why there’s been stronger demand for horizontal rigs that specialize in fracking. Even those numbers have started to diminish in the last couple weeks.

Hat Tip: Jonathan Schultz, Kellogg MBA student

You are Chair of your Department and the Department hires two people at the senior level. It is hard to hire at the senior level and many people congratulate you on your success. But the candidates were proposed by others and wooed by others. One is moving because of a divorce and the other is a lemon who is despised by his former colleagues. All you did as Chair was handle the admin stuff and yet everyone still congratulates you. If you had failed to hire, they would have blamed you, even though all that happened was that a marriage worked out and a lemon went elsewhere.

This kind of stuff happens all the time. Why?

The simplest explanation comes from the Principal-Agent model with the Chair as the Agent and the Department as the Principal. In an optimal contract, the Agent is punished for low output and rewarded for high even though in equilibrium we know he has already sunk high effort and output reflects a random shock. If we forgave the agent low output – after all it was a random shock – it would undercut the Agent’s ex ante incentive to exert effort. Similarly, the Department should venerate or denigrate the Chair based on success or failure at senior hiring. Otherwise, you would never work at all on senior recruiting.

It’s best to start at $1.50 a slice.

That is what pizza was selling for about a year ago at a family business that is a combination vegetarian Indian restaurant, candy store and pizza parlor on Avenue of the Americas (also known as Sixth Avenue), between 37th and 38th Streets. It is called Bombay Fast Food/6 Ave. Pizza.

Then a Joey Pepperoni’s Pizza opened near the corner of 39th and Avenue of the Americas, offering pizza for $1, a price that has in recent years been favored by a number of New York pizza establishments.

So Bombay/6 Ave. Pizza shrank its price to $1 too.

All was good until last October, when a third player entered the drama.

A 2 Bros. Pizza, part of an enlarging New York chain of 11 shops that sell slices for a dollar, opened virtually next door to Bombay/6 Ave. Pizza. The only separation is a stairwell that leads up to a barbershop and hair salon.

Price stability at a buck all around persisted until eight days ago, when both 2 Bros. and Bombay/6 Ave. Pizza began selling pizza for the eye-catching price of 75 cents a slice, tax included — three slender quarters.

There is a sign that some parties hope things get better:

For his part, Eli Halali made it clear that 75 cents was a temporary price point. He said he could not make money at that level and eventually would return to $1. He said that if Bombay/6 Ave. Pizza went back to $1, he would as well.

But emotions may overcome reason:

If it didn’t, he said, it better watch out.

His father, Joshua Halali, who acts as a consultant to 2 Bros., said, “I suggested to my children to go to 50 cents.”

Oren Halali said, “We might go to free pizza soon.”

Eli said: “We have enough power to wait them out. They’re not going to make a fool of us.”

The brothers said they are also contemplating adding fried chicken to the Avenue of the Americas store to intensify the pressure on Bombay/6 Ave. Pizza.

Meanwhile, Mr. Patel remains intransigent. “We’re never going back to $1,” he said. “We’re going lower.”

“We may go to 50 cents,” Mr. Kumar said. Of his next-door rival, he said: “I want to hit him. I want to beat him.”

Differentiation may protect them. Yelp reviewers love the Indian items at Bombay Fast Food. The Halalis should introduce some Middle Eastern items. And perhaps Bombay Fast Food should just get out of the pizza business. This will allow pizza prices to go up. Then, pizza sales will stop cannibalizing profits from the Indian food operation.

The nationally recognized Piven Theatre Workshop would play a leading role in the revitalization of the Noyes Cultural Arts Center, occupying renovated space and a state-of-the-art theater in the building under a plan that received backing Monday from a city committee…

With past efforts to change things at the city owned building “not going as smoothly, as easily as we wanted,” the new plan seems to heading the city in the right direction, said Alderman Judy Fiske, in whose 1st Ward the building is located….

Piven Theatre officials are proposing to occupy the southern one-third of the building and would extensively renovate the area with new classrooms, rehearsal space, offices and a new theater, he said……

The building, which leases space at below-market rates to artists, faces substantial repairs, including a new roof and heating and air conditioning system.

City officials have looked at a new model for operating the center, a former school building, including asking tenants to take a greater role in the building’s upkeep.

Because of the ambiguity, Piven officials told [officials] last fall they were likely moving out of the building, and possibly out of Evanston…

Clear property rights are necessary to resolve the hold up problem.

But a battle to establish property rights can generate a war of attrition and hence the hold up problem. For the Church of thew Holy Sepulchre inthe Old City in Jerusalem:

The primary custodians are the Eastern Orthodox, Armenian Apostolic, and Roman Catholic Churches, with the Greek Orthodox Church having the lion’s share. In the 19th century, the Coptic Orthodox, the Ethiopian Orthodox and the Syriac Orthodox acquired lesser responsibilities…

Under the status quo, no part of what is designated as common territory may be so much as rearranged without consent from all communities. This often leads to the neglect of badly needed repairs when the communities cannot come to an agreement among themselves about the final shape of a project….A less grave sign of this state of affairs is located on a window ledge over the church’s entrance. Someone placed a wooden ladder there sometime before 1852, when the status quo defined both the doors and the window ledges as common ground. The ladder remains there to this day, in almost exactly the same position it can be seen to occupy in century-old photographs and engravings.

If one church fixes something, they then claim property rights over the thing they fix. Hence, all repair is vetoed

The big event of this week in the U.S. will be the Supreme Court discussion of the Affordable Care Act aka “ObamaCare”, a supposedly derogatory nickname now embraced by the Obama campaign. At the heart of the fight is the so-called individual mandate which requires everyone to purchase health insurance. A related and important argument is that additional provisions, such as requiring coverage for individuals with preexisting conditions, become prohibitively expensive without the individual mandate. This is because, without the mandate, healthy individuals will not buy insurance till they become sick and this drives up costs of insurance companies. So, if the individual mandate is struck down, the argument goes, the court should also strike down the requirement that insurance companies cover individuals with pre-existing conditions.

I am not a lawyer but the main argument for canceling the individual mandate turns on whether the federal government has the right to penalize an individual if they do NOT take a certain action. There is plenty of precedent for taxing “action” but can the federal government tax “inaction”? Many amicus briefs have been filed but there are two key ones by economists.

David Cutler, who worked in the Obama administration, has filed one with many co-signatories (including Akerlof, Arrow, Maskin, Diamond, Gruber, Athey, Goldin, Katz, Rabin, Skinner etc.). They say there is no such thing as inaction. A conscious decision to forego healthcare is an action and hence under the purview of existing law. Foregoing insurance also affects outcomes largely by shifting costs to others and hence is not a neutral decision.

The other side of the argument is filed by Doug Holtz-Eakin with co-signatories inclusing Prescott, Smith, Cochrane, Jensen, Anne Krueger, Meltzer etc.) First, they argue that if an individual does not want to buy converage it must be because the costs outweigh the benefits. Second, they argue about the numbers, claming the costs imposed by the uninsured on the insured (“cost-shifting”) are far below the $43 billion estimated by the Government Economists and are more like $13 billion.

The first part of the Holtz-Eakin argument is, to me at least, odd. Uninsured individuals can get healthcare for free in the emergency room. Hence, they can get the benefits of healthcare -or at least healthcare in extreme circumstances – without the costs. So, of course for them the benefits are outweighed by the costs because they get the benefits anyway. The argument by Holtz-Eakin presumes that the individuals are not free-riding and so their private decisions fully reflect the costs and benefits but they do not. Then, the second part of the argument which admits there is cost-shifting going on basically makes the point I am making – if there is cost-shifting, there is free-riding and then individual’s decisions do not fully internalize costs and benefits.

There has to be a better argument against the individual mandate than this. I looked at Senator Rand Paul’s brief. The precedent for this case is a 1942 case involving an Ohio farmer who was exceeding his quota of wheat production. Footnote 6 caught my eye:

So infamous is the case, it has been set to music, to the

1970s tune of “Convoy”:

“His name was farmer Filburn, we looked in

on his wheat sales. We caught him exceeding

his quota. A criminal hard as nails. He said,

“I don’t sell none interstate.” I said, “That

don’t mean cow flop.” We think you’re

affecting commerce. And I set fire to his crop,

HOT DAMN! Cause we got interstate

commerce. Ain’t no where to run! We gone

regulate you. That’s how we have fun.”

Will this convince Justice Kennedy or is it cow flop?

Dr Richard Weitz, Senior Fellow and Director of the Center for Political-Military Analysis at Hudson Institute said: “From our perspective, China should have done more in terms of security. From their perspective, they didn’t need to; they could free-ride, we were going to do it anyway. They didn’t see any point because all they would do is incur a lot of sacrifice and antagonise the Taliban and the global terrorist movement, and they’d rather let us incur that.”

Why aren’t Western countries going in there themselves?

Peter Galbraith, former deputy head of the UN mission in Afghanistan, said: “Western companies are exceptionally timid when it comes to operating in places where there is even the remotest hint that it might be a little risky, and the Chinese are not and are willing to go to these places. And the Chinese have business practices that Western countries … let’s just say that Chinese generosity towards local officials exceeds that of what Western companies are capable.”

I guess some might argue trade is good for Afghanistan and hence for us if trade leads to a stable prosperous economy. But as I have made it to Chapter 4 of Acemoglu and Robinson’s Why Nations Fail, I worry that Afghanistan will adopt “extractive political institutions” and all this trading will lead nowhere except a Swiss bank account.

In my search for examples for a paper, I found:

The context of our analysis is the laundry services industry because it is well suited for analyzing both

vertical integration and social networks. Each store makes two make-or-buy decisions: one for

drycleaning and another for laundry. These are the primary services offered by a store, and whether or

not they are produced in-house can easily be revealed. Furthermore, the industry has long been associated

with ethnic concentration, such that in the southern California region where we focus our analysis,

Koreans currently own more than 2,000 cleaners….The greater concentration of Koreans in Koreatown and the communication between them suggests

that “word-of-mouth” (or reputation effects) will spread faster within this area. An upstream cleaner

supplying a Korean cleaner in Koreatown recognizes that their conduct can affect their reputation

with their other Korean customers in Koreatown….Therefore, while a network of Korean cleaners outside Koreatown could yield some

network effects, we expect these to be smaller. Our analysis therefore concentrates on the network effects

of Koreatown relative to other small networks of Korean cleaners or the lack of networks.

A Generalist is good at many tasks, a Specialist only good at one. Demand for the output at each task fluctuates so it is good to have someone who can perform many tasks so “supply can match demand”. So, the Generalist is better for the firm than the Specialist.

But the Generalist’s life is hard – she is taking on a lot of risk. What will she be working on next? And she is the same rank as the specialist so she gets the same rewards. Better to coast on the tasks she likes least and work hard on one. More predictability and a better idea of what task to get better and better at performing.

So, generalists should disappear in the long run and the firm will just have specialists. Unless they can think of some way to reward generalists.

People who read e-books on tablets like the iPad are realizing that while a book in print or on a black-and-white Kindle is straightforward and immersive, a tablet offers a menu of distractions that can fragment the reading experience, or stop it in its tracks.

E-mail lurks tantalizingly within reach. Looking up a tricky word or unknown fact in the book is easily accomplished through a quick Google search. And if a book starts to drag, giving up on it to stream a movie over Netflix or scroll through your Twitter feed is only a few taps away…

“The tablet is like a temptress,” said James McQuivey, the Forrester Research analyst…. “It’s constantly saying, ‘You could be on YouTube now.’ Or it’s sending constant alerts that pop up, saying you just got an e-mail. Reading itself is trying to compete.”

My (quite old) Kindle loses battery power rapidly if you attempt to use its wireless capabilities and its browser lacks the capability to access webmail or surf the web comfortably. So, you have only one option – use it to read. Fewer options are better is you lack self control. Far sighted readers who easily fall prey to Twemptation should stick with the Kindle over the iPad.

There are three divisions in a firm, A, B and C. Each makes a different kind of product. Resources are allocated from Center and the three divisions compete for them. Over time the members of each division generate ideas for new products that need funding. The ideas may be good or bad and the division members get an accurate signal of the quality of the idea. The members of other divisions get a noisy signal or no signal at all. The three divisions have to send a vote to the Center which will determine whether to fund the idea or not. The greater the number of divisions supporting an idea, the more likely it is to be funded by Center.

Division A is “honest”. They only push their ideas if they are good. They support the ideas of other divisions if and only they become convinced by objective arguments that they are good.

Division B is an “empire builder”. They push all their ideas as if they are all good. They thrash other divisions’ ideas if they feel threatened.

Division C is “honest yet strategic”. They push their ideas if and only if they are good. How should they vote on other divisions’ ideas? Division A is likely to be on their side when they push an idea. After all, Division C only support their own ideas if they have a good signal. They can then convince Division A of the strength of their case. To convince Center, it would be even better to have a unanimous decision with Division B on board. So, Division C supports Division B’s ideas. If Division A proposes an idea for funding and Division B opposes it, Division C sides with Division B. A quid-pro-quo equilibrium develops between Divisions B and C.

In the long run, Division A will die out. This is bad for Center as Division A’s good products are good for profits and Division B’s bad products are not. So perhaps Center will intervene. Or Division A may also become strategic. They should deliberately destroy some of Division C’s good potential products and persuade them to switch their support to them over Division B.

In an under-caffeinated state yesterday morning, I picked up the NYT Travel section to see where I might escape once my teaching is over in a few weeks. Nogales, Mexico, seemed easy to get to – you just go to Nogales, Arizona, and walk across the border. Good for tacos and cheap dental work.

A few hours and several coffees later, I settled down to read Why Nations Fail, Daron Acemoglu and Jim Robinson’s new book. It summarizes their many years of research (some with Simon Johnson) on political and economic institutions and their impact on economic growth. The book has no equations, graphs or tables and is aimed at a popular audience. The book begins by comparing the colonial history of Mexico and the U.S.

Mexico was settled by Spanish conquistadores who extracted as much gold and silver as possible and used the population as slave labor. The British tried to take the same approach when they arrived in Virginia. But there was no gold or silver and the population density was low. They were forced to set up political institutions that fostered economic activity. Settlers eventually got to keep a large slice of any surplus they generated and got the right to vote on taxation (this led to trouble for the British in the long run!). All very interesting and yet it seemed familiar. Eventually it dawned on me that a key Acemoglu and Robinson motivating example, used to show the importance of institutions, is Nogales Arizona vs Mexico. The geography is the same and yet the political institutions are quite different. And so are the economic outcomes. So, geography is not the major determinant of economic outcomes (roughly the theory of Jared Diamond) and political institutions are at the core of economic development.

Serendipity, synchronicity, call it what you will, but the time seems ripe for this book. Acemoglu and Robinson have a blog to accompany their book. I suppose they will interpret comtemporary events through the lens of their theory. I look forward to reading it on a regular basis.

The Cubs are finally ready to end their losing streak.

After years of being out-hustled by secondary ticket brokers, which flip high-demand seats for huge profit, the North Siders are stealing a page from their South Side rival’s playbook and implementing “dynamic pricing” in their 5,000 bleacher seats this season.

Until recently, all 30 Major League Baseball teams set prices well before the start of the season, leaving their hands tied on game days, when StubHub Inc. sellers might be hawking the same tickets for twice as much. Now, if demand spikes, the Cubs can hike prices much like airlines do as departure time nears.

“Teams are looking at (dynamic pricing) to capture some of that secondary market that they’re not capturing,” says Colin Faulkner, the Cubs’ vice president of ticket sales and service, who implemented the new system when he worked for the NHL’s Dallas Stars before moving to Wrigley Field in 2010. Mr. Faulkner says the dynamic pricing will supplement a tiered system in the bleachers, where initial costs range from $17 to $78 apiece.

(Hat Tip: Kathryn Landis, Kellogg MBA)

We blogged many times about the Next restaurant’s innovative ticket scheme. Potential restaurant goers had to sign up to try to acquire seats at a fixed price for a set meal. Good for the restaurant in terms of knowing what inventory to hold, predictable revenue etc. The scheme turned out to be extremely successful with resale prices of the tickets running into thousands. Why not just auction off the seats – that is what very economist would say? It turns out that Nick Kekonas and Grant Achatz do not want to make too much money and want everyone to be able to afford to come. In response to my blog post Nick commented:

Since we have universally high demand right now, the question is why don’t we flatten the pricing towards the top of what the market will pay? There are a few reasons for this, mostly having to do with customer service and the hospitality industry. Simply, we never want to invert the value proposition so that customers are paying a premium that is disproportionate to the amount of food / quality of service they receive. Right now we have it as a great bargain for those who can buy tickets. Ideally, we keep it a great value and stay full.

I replied

If you want to give it to charity, to start a foundation to teach disadvantaged kids how to cook or whatever is close to your heart, that surely dominates just giving up the money to random lucky people who sign up and sell tickets for profit on Craigslist. And given you have software already, I bet it would be pretty easy to program a simple auction.

My advice was pretty obvious and I’m sure they though of it already. Anyway:

Next created a special page to run a Dutch auction for an El Bulli menu two-top every night, all proceeds to go to the University of Chicago Cancer Center where Grant Achatz was treated….

Not surprisingly, there are a lot of people who couldn’t stand to wait for Next El Bulli tickets to come down in price— as of this writing 46 of the 72 tables, many of them for the $5000 maximum price (compared to about $800 for a regular pair of Next El Bulli tickets; most of that will be tax deductible as a donation) have sold for a total of $215,000. Odds are the entire block will sell out later today, bringing in around $350,000 for the hospital in little over a day. Next’s food fascinates, but it’s hard not to think that Next’s radically innovative business models will prove equally important and influential for the restaurant industry and its extensive charitable involvement over the years to come.

Many people’s thoughts turn to contraception on Valentine’s Day. But thanks to the election campaign and the implementation of the Affordable Care Act, Americans have been thinking about contraception for several days. The ACA mandates provision of contraception by healthcare plans including those managed by Catholic hospitals.

What is the rationale for a mandate in a competitive labor market? The Becker model of discrimination predicts the mandate is unnecessary. Suppose employers choose not to offer contraception benefits in healthcare plans. But talented workers may value these benefits. Then an employer can deviate and offer contraception benefits or a new firm can enter and offer benefits. They can attract individuals who value the benefits, produce higher quality products at lower costs etc. etc. The classic textbook economics model. The mandate requires the contraception benefits be free. But the insurance companies will simply include them in the price they charge for other services. Nothing is really free.

I suppose that if the government simply makes it illegal for any healthcare plan to offer contraception benefits, this argument breaks down. But is any politician advocating this position, even Santorum? Instead, the Republicans run the risk of alienating independent and moderate voters. They have a coherent libertarian style argument against the mandate and have succumbed to a weaker argument. Meanwhile President Obama seems to have “turned a crisis into an opportunity” to use a MBA teaching cliche. According to Andrew Sullivan,

The more Machiavellian observer might even suspect this is actually an improved bait and switch by Obama to more firmly identify the religious right with opposition to contraception, its weakest issue by far, and to shore up support among independent women and his more liberal base….

Take a look at the polling. Ask Americans if they believe that contraception should be included for free in all health-care plans and you get a 55 percent majority in favor, with 40 percent against. Ask American Catholics, and that majority actually rises above the national average, to 58 percent. A 49 percent plurality of all Americans supported the original Obama rule forcing Catholic institutions to provide contraception coverage.

If the GOP really makes this issue central in the next month or so, Santorum (whose campaign claims to have raised $2.2 million in the two days following his victories last week) is by far the likeliest candidate to benefit..—especially since Romneycare contained exactly the same provisions on contraception that Obamacare did before last week’s compromise was announced. That’s right: Romneycare can now accurately be portrayed as falling to the left of Obamacare on the contraception issue. This could very well be the issue that finally galvanizes the religious right, especially in the South. Imagine how Santorum could use that on Super Tuesday. In fact, it could be the issue that wins him the nomination. And do you really think that would hurt Obama in the fall?

The answer is tantalizingly close and yet just out of reach. An interested reader can find some of the relevant information here, in a Deutsche Bank prospectus for potential investors in Bain Capital. On pages 16 and 17, the prospectus lists all the investments made by Bain Capital from 1984-1998, roughly the time that Mitt Romney ran the company. For example, their 1984 investment of $2 million in Key Airlines led to an annual return of 52.9%. It does not tell you how much money investors made because you would have to subtract off Bain’s fees which this Table does not have (other parts of the prospectus may help you to do that). The thing that is impossible to work out is the employment impact of Bain’s investments. The prospectus does not say anything about that issue. But the names of the companies are listed in the left hand column. So, it might be possible to work out what happened to these companies via a web search and come up with some answers.

If someone had the time and the ability to do that, it would be very interesting I think. I’d certainly be interested in the answer.

Diehard Downton Abbey fans didn’t watch the SuperBowl, preferring the trials and tribulations of Matthew and Mary to the seesawing fortunes of Tom and Eli. Series 2 has already been shown in the U.K., as well as a Xmas special. For those who could not work out how to set up their computer to mirror British I.P.addresses and watch it on streaming video, the wait has been long. How can they get their Downton Abbey fix? They could get the British DVD version and have it shipped. But will it work on their DVD player? But do not worry, the producers are going to give the fans a relaxing spliff – series 2 is coming out on DVD is the US on Feb 7. Cunning on two levels.

First, there is plenty of time to have it shipped and get it in time for Valentine’s Day for your loved one. (Reminder to self – get the dvd asap)

Second, and more dastardly, the rabid fans can get to watch all the episodes yet to be shown on PBS (and maybe even the Xmas special?). The timing is perfect. Release it any later and people will have seen the end and fewer people will buy it. Release it any earlier and PBS will not pay as much for the TV rights. Someone’s thinking back in England – probably a working class guy who would have been a footman in Downton Abbey days but now runs ITV.